Hungarian budget starts the year with a surplus

The Hungarian budget posted a surplus in January, but this is hardly a game-changer in 2021 as we’ve become fairly accustomed to good starts in the last few years

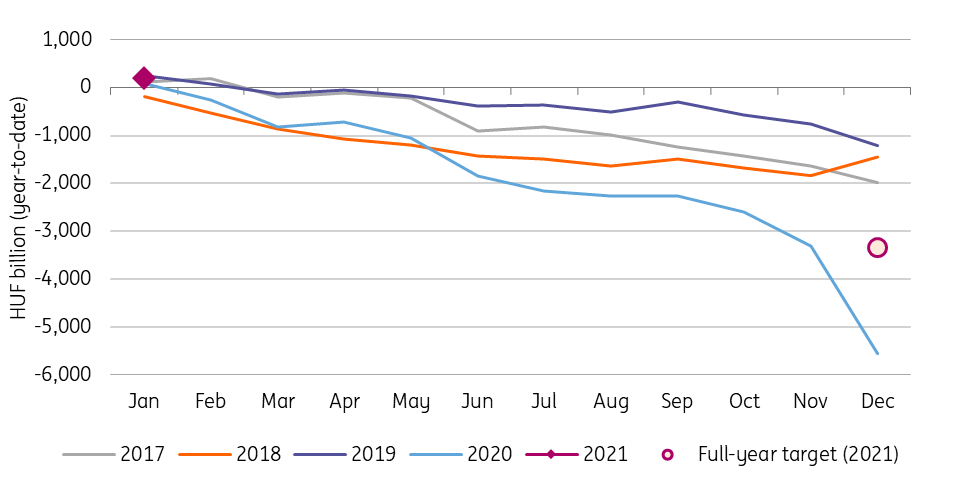

The Hungarian budget posted a surplus of HUF 198.8bn in January 2021, which looks like a promising figure, especially after the spending spree in December. However, it is too early to reach any conclusions.

The government has started the year with a budget surplus every year since 2016 except for 2018 and we have seen a wide variety of deficit data by the end of the year. The finance ministry also highlighted this seasonality in its statement.

The government’s accrual-based deficit goal is 6.5% of GDP for 2021 after an approximately 9% shortfall in 2020. When it comes to financing requirements, the 2021 financing plan of the government's debt management agency sees a HUF 3,332bn cash-flow based deficit. This target hasn’t changed despite the record spending in December, as this extra expenditure was financed from previously raised bond supply and government reserves.

Overall, this year’s deficit figures will continue to be impacted by the pandemic and economic relief efforts.

Cash-flow based year-to-date central budget balance

The January figure doesn't reflect the financial impact of the latest announcement.

The Economy Reopening Action plan targets to jump-start the Hungarian economy helping micro, small, and medium-sized enterprises. The program contains interest-free credit pool (HUF 100bn financial framework), investment incentive programmes, tax reductions and payroll supports.

This new action plan should be in line with the official deficit goals, so we don’t see a slippage due to this new package. In all, we see the 6.5% accrual-based deficit plausible, which gives a lot of flexibility to the government to support the economy in 2021, just a year ahead of the elections.

When it comes to risks, the deficit was planned with a cautious approach regarding the macroeconomic environment.

It was based on moderate 3.5% GDP growth and 3% inflation. We see both figures coming in higher in 2021, as we expect a 4.3% economic activity with a 3.3% average inflation, both forecasts surrounded by upside risks.

But even if the budget performs better-than-expected, we see the government using the extra room to spend more (eventually matching the deficit target).

The reasoning is simple: economic support tends to pay better in votes than a smaller deficit.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

HungaryDownload

Download snap