Hungary: Budget deficit overshoots the yearly target

The central budget deficit increased further to HUF2.16tr in the first seven months of 2020. This means the budget has already overshot the full-year target

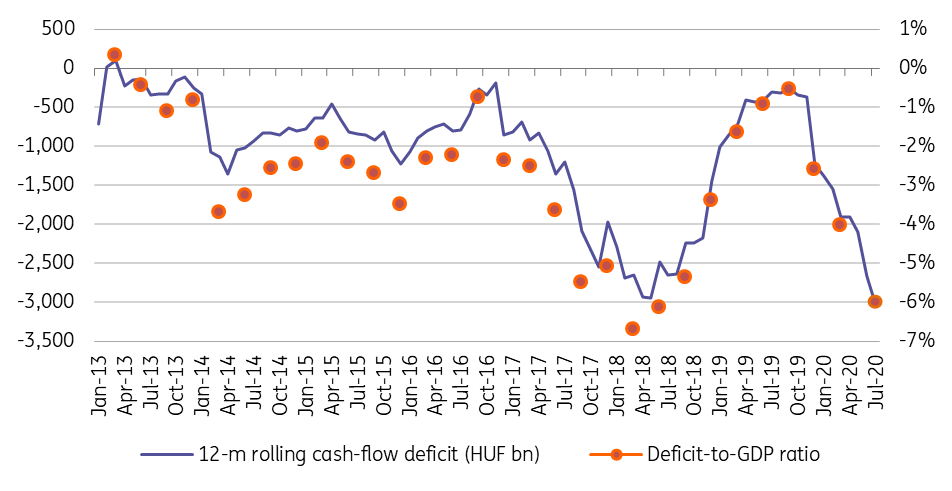

| 6% |

Deficit-to-GDP ratio in the past 12 monthsING estimation |

The general government’s deficit came in at HUF2,165bn in the January-July period of 2020. It’s more than six-times higher than the cash-flow based deficit in the same period of the previous year. The government accumulated a HUF352.7bn shortfall in July alone, a much better monthly performance than in the peak of the Covid-crisis.

On the revenue side, the government did not get any relief from Brussels in July as no money was transferred to the budget. This means that the year-to-date inflow remained at HUF489.5bn. In contrast, the EU related spending – due to the government’s approach to pre-finance the projects from the budget – reached HUF1274.9bn. So, roughly 36% of this year’s cash-flow based deficit is coming from the EU-related expenditures.

Another 24% of the deficit (HUF520bn) is accumulated due to the expenditures related to Covid-19 defence. The government has also spent a lot of money on infrastructure developments, such as road building and maintenance. Another one-off expenditure in July was stemmed from a lump sum bonus to healthcare workers worth HUF101.3bn.

The year-to-date budget balance of the government

Revenues here, expenditure there, at the end of the day only one thing matters: can the official deficit target be met? In our view, the target is not just in danger, but it seems unrealistic. The last official target was set at HUF1,890bn (3.8% of GDP). In the first seven months of the year, the cash-flow deficit target is already 15% above the target. Even if we know that revenues and expenditures are not proportional during the year, it’s still alarming.

The 2020 deficit could easily end up around 8% of GDP.

Checking the 12-month rolling monthly data, the HUF3,031bn shortfall by July could mean a 6.0% deficit-to-GDP ratio (which we calculate with our -10.5% year-on-year 2Q20 GDP forecast). So, even if we assume that the last five months of 2020 would be the same as last year’s from a budgetary point of view, which we believe is overly optimistic, the government’s deficit target is well out of reach. Moreover, we expect a recession in the coming quarters, meaning further dropping budget revenues and mounting expenses on economy protection programmes and ballooning expenditures related to Covid-19 defence. All in all, the 2020 deficit could easily end up in the 8% of GDP area.

12-month rolling deficit

This means that sooner rather than later the Ministry of Finance needs to revise the deficit target again and the Debt Management Agency is going to update its financing plan accordingly. This would mean inflated supply of Hungarian government bonds in the coming months, possibly with a stronger involvement by the National Bank of Hungary using its government bond buying programme.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap