Hungary: An expected slowdown in retail sales

The latest performance by the retail sector has been the second worst in 2018 so far and was mainly due to the weaker turnover in non-food shops. The sector has been on a downward slope suggesting slower GDP growth in the coming months too

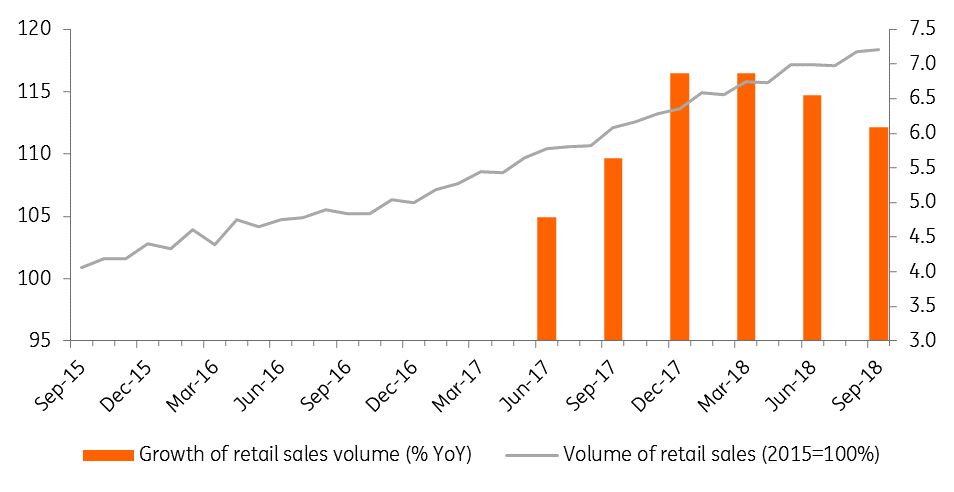

Retail sales turnover, adjusted for working days increased by 5.4% year on year in September. Since the market expected a slowdown, the data hardly qualifies as a surprise.

Nevertheless, the latest performance by the retail sector has been the second worst in 2018 so far. It is worth noting that the growth rate of the turnover in the retail sector, except for some corrections and outliers, has been on a downward trajectory since January 2018. This is also supported by the declining 3-month average activity figures.

Volume of retail sales

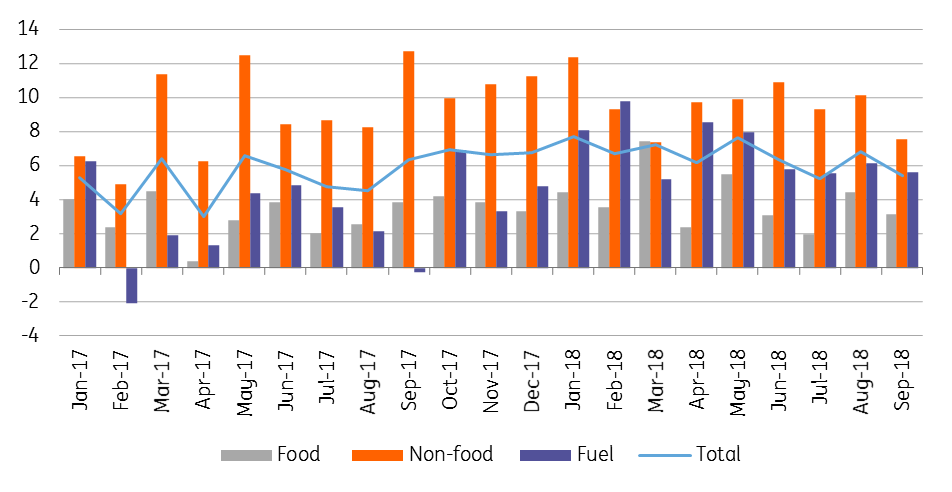

The details show a slowdown in all of the main subsectors. The non-food shops marked the most significant deceleration in September, as the 7.6% YoY growth has also been the second worst in 2018 so far.

Considering the food-shops, the expansion roughly matched the average of 2018. As fuel prices increased significantly in September, the sales turnover in automotive fuel sales decreased slightly.

Breakdown of retail sales (% YoY, wda)

As for the coming months, the robust labour market may maintain the favourable growth dynamic, although we don’t expect the slowdown to stop. Despite the deceleration, the performance of the retail sector in 3Q18 still supports the economic activity albeit we see a lower contribution to GDP growth via the consumption channel, supporting our call of a slowdown.

Nevertheless consumption will remain the main contributor when it comes to the country’s GDP growth.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap