Hungarian inflation proves stickier than expected

Even though headline inflation mildly decelerated in March, the underlying price dynamics look rather worrisome. The uptick in core inflation should reduce any speculation among market participants for an early rate cut by the National Bank of Hungary

| 25.2% |

Headline inflation (YoY)ING forecast 24.8% / Previous 25.4% |

| Higher than expected | |

Markets were expecting a more pronounced deceleration in inflation

At first glance, the development of inflation in March looks good as headline inflation fell further. However, the 25.2% year-on-year (YoY) print is only marginally lower than February’s release and was an upside surprise compared both to the market and ING's forecasts. Not to mention that a 0.2ppt drop from that high level looks like a rounding error. The bottom line is that the March inflation is far from reassuring.

As always, the devil is in the details and speculation that we have seen the peak in core inflation seems to have been premature. Core inflation jumped by 0.5ppt to 25.7% in March. The upside surprise in core inflation is the biggest takeaway from the March release. This signals that the underlying price dynamics remain strong, and thus the National Bank of Hungary (NBH) has no room for a monetary policy pivot.

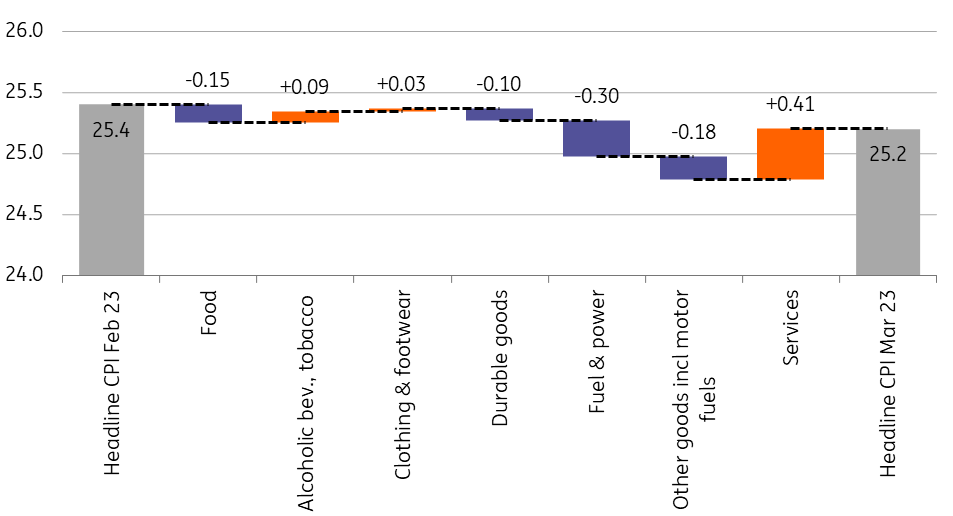

Main drivers of the change in headline CPI (%)

The details

- Food inflation has continued to moderate for a third month, as the annualised index retreated to 42.6% year-on-year, which is still extremely high. However, the month-on-month (MoM) food price increase remains still elevated at 1.5%. This is clearly an upside surprise as we expected a more marked retreat in food inflation based on the marketing campaigns on food sales by the grocery stores. We are hopeful that this price competition will finally show up in the inflation reading in the coming months.

- Motor fuel prices retreated in tandem with the decline in oil prices and stronger Hungarian forint, and the disinflation was in line with expectations. In parallel with fuel prices, household energy prices likewise retreated, due to a decrease in household energy consumption, which lowered the weighted average unit price of piped gas. In the near term, we think these trends will continue, although global energy price developments pose a substantial risk in the second half of the year.

- Services inflation came in at 1.9% MoM bringing the annualised index to 13.0%. The main culprits behind the jump were price increases by telecom and holiday services providers. In our view, this was the single most important upside surprise in the March data release as the services sector is trying to pass last year’s cost burden onto consumers with a lag. Going forward, the pre-announced price increases by telecom companies and the seasonal repricing in holiday packages will keep services inflation elevated.

- Somewhat surprisingly, repricing has continued in alcoholic beverages, while the uptick in clothing prices is due to a stronger seasonal factor. The monthly decline in durable goods prices can be attributed to the stronger forint.

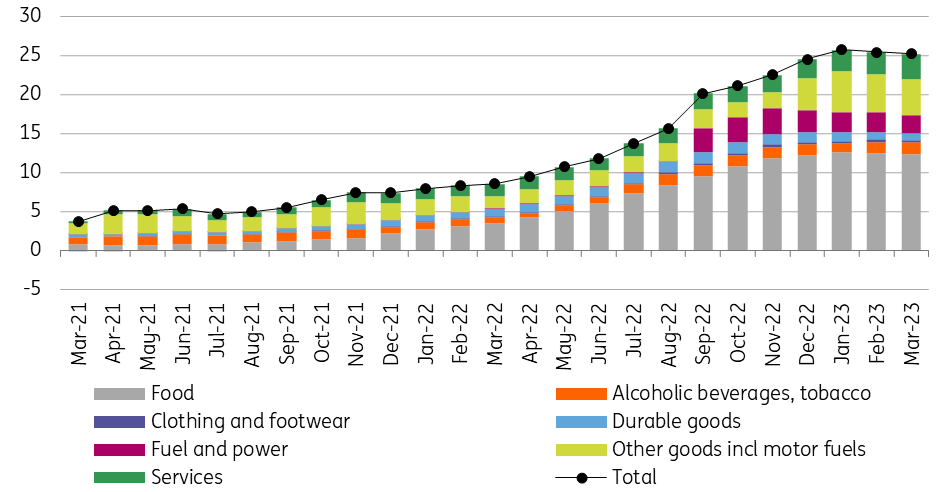

The composition of headline inflation (ppt)

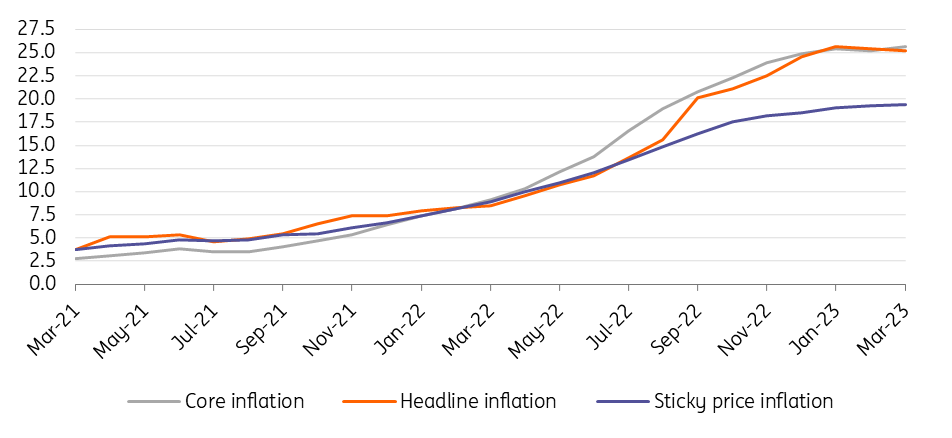

Core inflation has surprisingly reaccelerated

In February, both headline and core inflation retreated, and we thought that both measures would likely fall in the coming months. However, March’s inflation release shows a divergence between the two measures, as core inflation ticked up to 25.7% YoY, which is the result of a 1.5% MoM increase. Volatile (non-core) items are pulling down headline inflation but more persistent inflationary developments keep strengthening. This view is likewise supported by an uptick in the NBH’s sticky price inflation index, which moved to 19.4% YoY. In this regard, inflation looks stickier than expected.

Headline and underlying inflation measures (% YoY)

Government’s 2023 inflation forecast looks increasingly unrealistic

Judging by the developments in the first quarter, the government’s 15.0% average inflation forecast for 2023 is increasingly unrealistic. For this year, we continue to expect average inflation to be substantially higher than last year’s. We are pencilling in a reading around 19%. At the same time, we still see a chance that the rate of year-on-year price increases could dip below 10% by December.

However, the risk of a persistently high inflation environment has not been averted. The very dynamic wage growth could translate into positive real wage growth in the second half of the year, which on one hand could support the economic recovery from the current technical recession. On the other hand, it risks companies regaining their price-setting power, triggering further repricing. If in tandem with improving purchasing power, consumers focus on replenishing depleted reserves, then a wage-price spiral could be avoided. Nevertheless, this scenario would lead to slower than previously expected economic growth in 2023, closer to 0.0%, rather than 1.0%.

No room for rate cuts yet

In light of March’s inflation data, the National Bank of Hungary has no choice but to continue to patiently watch the incoming data and wait at least until June to start the interest rate cutting cycle. As core inflation has just strengthened again, any hopes of a meaningful cut in interest rates in the near term have evaporated, in our view.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap