Hungarian industry’s sink or swim moment arrives

Industrial performance in Hungary was clearly on the way up before it was derailed by the Ukraine war. Yet, March data shows resiliency despite the plethora of challenges, while the real sink or swim moment is on its doorstep

| 4.2% |

Industrial production (YoY, wda)ING forecast 2.2% / Previous 4.8% |

| Better than expected | |

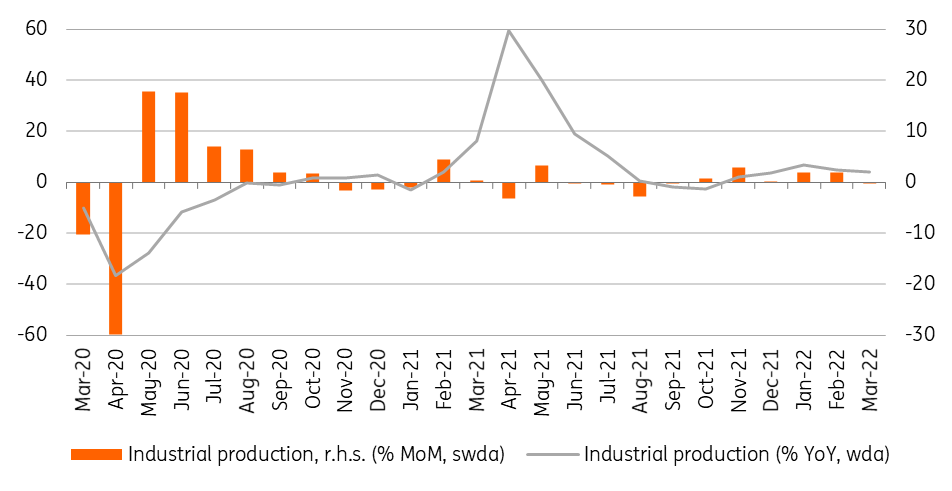

Although the volume of industrial production rose by 4.2% year-on-year in March (working-day adjusted), the Hungarian Central Statistical Office registered a 0.1% decrease on a monthly basis. Therefore, the dynamic growth seen during the first two months of 2022 has been broken. But it could have been worse.

Performance of Hungarian industry

After the outbreak of the war, automotive companies cut production hours and shifts in March due to a shortage of spare parts and logistic woes. Traces of this can be seen in the weaker performance of the industry. In its statement, the Statistical Office emphasised that the single most important sub-sector of industry – car manufacturing – saw production drop considerably in March.

In contrast, the other two major sub-sectors (electronics and food) showed above-average growth rates, counterbalancing the bad performance of vehicle production. However, perhaps these two sectors' good performances alone will not have been enough, so we wouldn’t be surprised if smaller sub-sectors performed well thanks to recent capacity expansions. The Statistical Office is going to release the detailed statistics in one week's time.

Production level and quarterly performance of industry

Given the outstanding performance of industry in the first two months of 2022 and the not-so-bad March data (given the circumstances), the volume of industrial production expanded by 5.5% year-on-year in the first quarter. If we also take into account the extremely strong growth of retail sales turnover during the January-March period, a dynamic GDP growth picture emerges. We expect that – similar to the fourth quarter of last year – the first quarter of 2022 could show 7% year-on-year economic activity. At the same time, based on other high-frequency data, we don’t rule out the possibility of even stronger GDP growth.

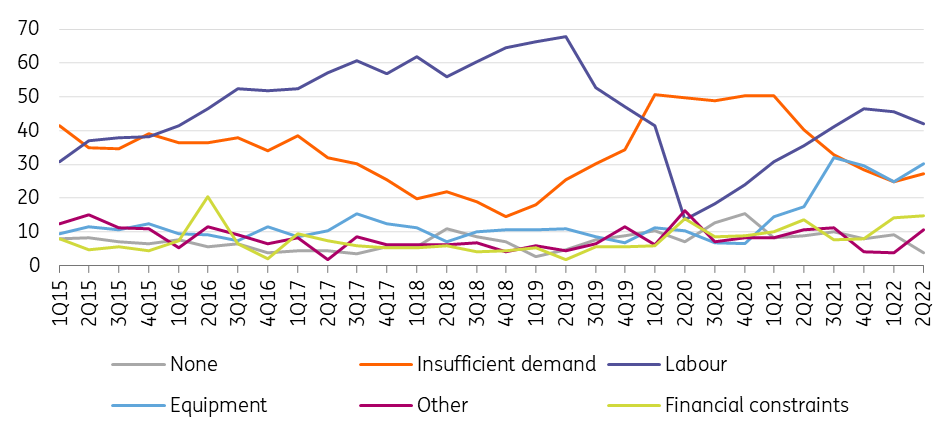

Looking ahead, problems affecting supply chains are unlikely to improve at any time soon. Industrial companies are trying to find alternative sources for spare parts, but it will take time, and this issue is reflected in the latest Eurostat survey about factors limiting production. In addition to the war, China’s zero-Covid policy is further exacerbating already existing logistical concerns.

Factors limiting the production in Hungarian industry (% of respondents)

So, practically, the Hungarian industry has reached its “sink or swim” moment. If companies are able to reshuffle their supply channels, keep their workers despite the rising salary demands on labour shortage, and adapt to rising financial constraints due to the higher interest rate environment, there will be better days ahead. The reason is simple: based on the stock of orders which is 26% higher on a yearly basis, the demand is clearly there to jumpstart production if limitations are easing. And those who are not flexible enough will sink.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap