Hungarian industry faces opposing forces

Weakening domestic demand continues to weigh on industrial performance, while export activities are dampening the plunge in output. However, risks are looming regarding the latter as well

| -5.8% |

Industrial production (YoY, wda)ING estimate -6.5% / Previous -4.0% |

| Better than expected | |

After two months of stagnation, Hungarian industry continued its freefall in April, as the volume of industrial production fell by 5.8% year-on-year (YoY), adjusted for calendar effects. The very bleak yearly-based performance is the result of a 2.5% month-on-month (MoM) decline in the volume of industrial production, after adjusting for seasonal and calendar effects.

In this regard, the underperformance is not only due to base effects but to the fact that the current performance is increasingly subdued, with production shrinking month by month. In the latest data available, production volumes in April 2023 were already as low as of the end of 2021, calculated on a fixed basis.

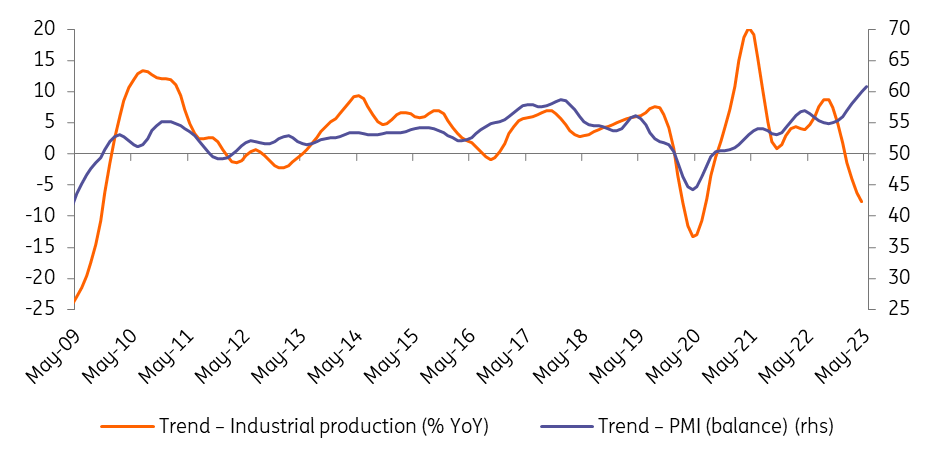

Performance of Hungarian industry

Even though the Hungarian Central Statistical Office (HCSO) will only release the detailed data next week (14 June), the preliminary statement highlights that the great majority of the manufacturing subsectors contributed to the production decline. What’s more, this time HCSO explicitly highlighted that output grew only in two subsectors, namely: transport, and electrical equipment manufacturing (e.g. EV batteries and cars). Overall this means that only those sectors that are related to the automotive sector are able to breathe life into the industrial sector.

In our view, the Statistical Office’s statement underscores our view that the performance of Hungary's industry continues to be dominated by contrasting dynamics. On the one hand, weakening domestic demand towards manufactured goods is heavily weighing on industrial output. As we pointed out yesterday in our retail sales piece, the volume of sales for manufactured goods in April was down by 4.5% compared to March, which highlights the lack of demand that Hungary's industry has been suffering from in recent months. What’s more, if we look at yearly dynamics, demand for manufactured goods was already down by a fifth compared to April last year.

On the other hand, export sales are essentially able to compensate, to some extent, for the very bleak performance of domestic sales. The order books of the observed manufacturing sectors show a similar picture, with export orders rising on an annual basis, while domestic orders are falling. However, the export market is not able to keep the overall output figure above water, thus we believe that the downtrend in industrial performance will continue in the second quarter of this year.

Volume of industrial production

Going forward, we believe that these contrasting dynamics will likely persist, but a big question remains for how long the export momentum can last. Recent surveys in Europe show that an increasing number of manufacturing firms are reporting that they are producing mainly for stocks and that order books are shrinking. In the retail sector, euro area respondents report a similar trend, as demand is weakening, and they are holding much higher inventories than usual, which sooner or later could catch up with Hungarian industrial production. On top of this, recent news of struggling German industrial production poses a risk to Hungarian export sales, as Germany accounts for 25% of the country’s export shares.

Moreover, the latest Chinese trade data is not encouraging for those hoping for a further recovery in global trade. These are all clear downside risks for Hungary's industry, which can currently only be supported by export-oriented sectors. The April aggregates for retail trade and industry thus continue to paint a gloomy picture for the Hungarian economy, which can only be pulled out of a technical recession in the second quarter by a good performance in agriculture.

Manufacturing PMI and industrial production trends

In light of today's data, we can only repeat what we have been saying from time to time, that the Hungarian PMI has not been reflecting reality for many months. In our view, this is due to the fact, that the most important industries, including the largest export-oriented companies, are strongly over-represented. Meanwhile, the slump in smaller manufacturers and more domestically-oriented sectors with a more modest weighting is more than offsetting the production indicators that are somehow linked to the automotive sector.

It is, therefore, time to review the methodology used to compile the index, which does not provide any meaningful information on the performance of industry. In any case, neither the value of the PMI nor its movements can be considered representative or indicative.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap