Hungarian economic activity looks good despite the circumstances

The phrase 'currency crisis' is often mentioned among investors when it comes to Hungary. In this environment, the recently-released economic activity data won’t be able to skew the big picture

The Hungarian Central Statistical Office has released its latest set of data about retail sales and industry. They look good considering the circumstances, but despite showing that Hungary might have a chance to avoid a quarterly drop in GDP during the second quarter, markets seem to be unaffected. The market's focus remains on global recession fears and the energy crisis, which is creating a risk-off sentiment with investors avoiding emerging markets, pushing the Hungarian forint to record lows on a daily basis.

Retail sales slow in May

In May, after extremely dynamic growth in the previous months, the expansion of retail sales slowed. At the same time – according to the calendar-adjusted data – the volume of turnover in the sector still expanded by 11.1%. Base effects are partly behind the slowdown, but the 0.1% contraction measured on a monthly basis suggests that there is more to it.

Looking at the details, food retailing showed stagnation on a monthly basis in May, but this cannot be considered extreme. In fact, due to last year's low base, this translates into a 3% annual expansion. A more serious issue can be seen in the case of non-food retailing. The 9.5% year-on-year growth is the slowest dynamic since January, with a 3.2% month-on-month drop in the subsector's turnover. It seems that households were able to spend most of the lump sum transfers they received in the first quarter (this can be seen in the big jump in retail sales in March), and after that the volume of consumption in non-food retailing decreased.

Breakdown of retail sales (% year-on-year, working day adjusted)

Within the non-food retail sector, the most dynamic expansion was measured in second-hand goods shops (54% YoY), which presumably shows the primary household reaction to runaway inflation. More people are trying to find alternative sources to buy goods at cheaper prices. This probably means that the structure of consumption has already started to change. Turnover in furniture and electrical goods stores increased by only 1.1% YoY, indicating a reduction in major spending.

Retail sales volume in detail (2015 = 100%)

The only positive surprise was provided by fuel retailing. Despite tightening restrictions on the price cap (fewer consumers are able to fill up tanks at the capped price), the turnover of fuel stations increased by 3% on a monthly basis, which resulted in an annual increase of 37.5% in May. However, it is important to note here that in the same period of last year, consumption was quite restrained due to Covid-19 restrictions.

Based on today's retail statistics, it is clear that Hungarians are adapting to higher inflation, but for the time being this has not yet brought a significant decline, but rather stagnation in the volume of consumption. The limited data available indicates that retail consumption may have plateaued in the second quarter of 2022 following an upward trend since the reopening in 2021.

For the time being, this means that consumption could still be higher compared to the previous quarter, so its contribution to the quarterly GDP growth could still remain on the positive side.

Industry is back on track, sort of

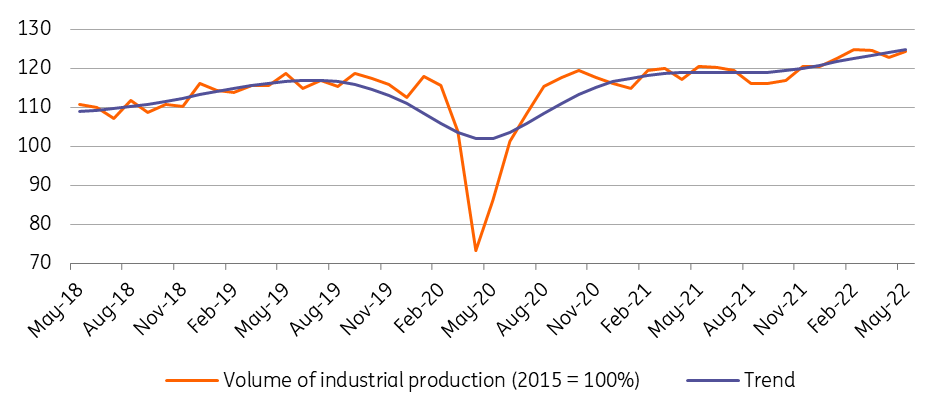

According to the raw data, industrial production rose by 9.4% on a yearly basis, while the rate of expansion is 3.4% when adjusted for the working day effect. The significant difference is due to the fact that there were two more working days in May this year than in 2021. This is not a bad performance in this environment, but the picture gets better if we check the month-on-month reading. This shows growth of 1.4%, ending a two-month period of decline in the volume of industrial production.

Performance of Hungarian industry

As we expected, after the initial shock of the Ukraine war and sanctions, companies have slowly found alternative routes to buy supply-constrained spare parts. The Statistical Office pointed out in its commentary that important sub-sectors such as vehicle manufacturing and the electronics industry were able to raise their production in May, which could be a sign of that adjustment happening.

However, it is too early to celebrate as the increase in May was only just enough to get close to the peak level of production reached pre-war. Looking ahead, the big question will be whether the two most important sectors (cars and electronics) will be able to further expand their production, and how much the food industry will be affected by supply disruptions (sanctions, war, drought). If the main sectors can adapt flexibly, and the smaller sub-sectors are also able to expand substantially, it is conceivable that the industry's contribution to GDP growth can be positive in the second (and maybe in the third) quarter.

Volume of industrial production (2015 = 100%)

In the first two months of the second quarter, for which we have hard data, industry showed a contraction on a quarterly basis. This means that a repeated good performance in June is needed to avoid a negative contribution from this sector to the GDP growth. There is some cause for optimism based on various surveys, such as manufacturing PMI, which jumped to 57 in June.

A mixed picture

Based on the April-May data, the picture regarding GDP growth has been mixed so far, and it is likely that it won’t get any clearer in June, especially if consumption were to moderate while industry recovered somewhat. Overall, we are rather cautious about the second-quarter GDP outlook, forecasting a minor contraction on a quarterly basis. However, this would still represent an above 5.5-6.0% year-on-year GDP growth for the April-June period.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap