Hungarian core inflation at a level not seen for 26 years

Core and headline inflation readings continue to climb, but the peak is in sight and will probably be well above 20%

| 19.0% |

Core inflation (YoY)ING forecast 18.6% / Previous 16.7% |

| Higher than expected | |

Inflation figures are rewriting the history books

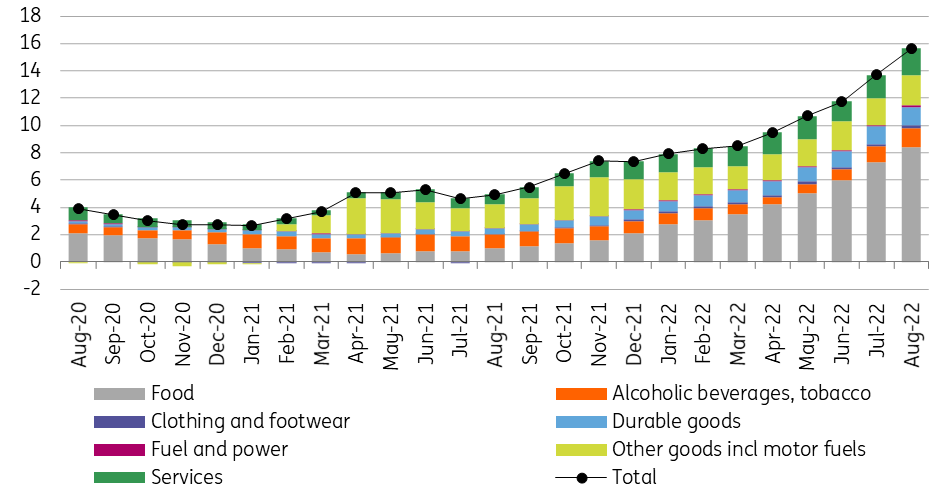

While August inflation came in below market expectations, this is of little consolation with the year-on-year reading reaching 15.6%, a level not seen since May 1996. On a monthly basis, the general price increase was 1.8%, which is extremely elevated compared to historical standards.

Main drivers of the change in headline CPI (%)

The details

- Price changes in food have remained the key factor for this extremely elevated inflation. It is also the most important contributor to the acceleration in price changes. Prices rose by almost 31% on a yearly basis, and at this point we can’t find a single item in the consumer basket where inflation is in the single-digit territory (except capped-priced products). In Hungary, a lean meal was once considered to be a slice of bread greased with butter or pork fat. Well now this is a luxury meal with inflation of 49.7% (pork fat), 54.5% (butter) and 64.3% (bread).

- Inflation accelerated in alcohol beverages and tobacco, probably as the full impact of the July excise duty hike arrived. But clothes became more expensive as well on a yearly basis as sales and rebates were few and far between compared to the usual summer sales period. Despite the forint appreciating somewhat during August, it gave no comfort to importers. Rising shipping costs, higher input prices and skyrocketing energy bills resulted in 14.8% inflation.

- Price increases in services accelerated on a yearly basis to 7.7%, as the monthly inflation was well above the year-to-date average again. It is really hard to highlight a single pain point, as there has been a widespread increase of price pressure everywhere in the services sector as providers face a huge energy shock with further rising labour and input costs.

- The only surprise came from fuel prices. The Statistical Office announced that it will recalculate the price of fuel as the government has made some tweaks to the price cap, allowing for fewer drivers to fill up gas tanks at administered prices. We expected a more significant outcome than the 0.3% month-on-month price increase, which actually translated into a lowering year-on-year reading.

The composition of headline inflation (ppt)

One-third of the consumer basket shows inflation of 20%+

As the most significant downward effect in inflation comes from fuel, which is part of the headline consumer basket, but not part of core inflation, a dichotomy has arisen. While headline inflation caused a downside surprise, core inflation shocked on the upside. The 19% year-on-year reading in August was even higher than our above-consensus forecast. Other factors are also suggesting that high prices are becoming more entrenched. For example, sticky price inflation – a good predictor of medium-term developments in price changes – moved up to 14.8% year-on-year. Also, broad-based price pressures are suggested by the fact that 34% of the items in the consumer basket have already shown at least a 20% YoY inflation figure in August.

Headline and underlying inflation measures (% YoY)

Inflation to peak above 20%

Inflation in Hungary is expected to rise further in the coming months. Corporates will probably continue to pass on some burden coming from the tax changes and higher energy costs to consumers. The changes in the utility bill support scheme will also have a pro-inflationary impact. According to our calculations, the rising price of electricity and gas will add an extra 3ppt to the inflation print from August. This is backed by the Eurostat HICP figure, moving the HICP reading to 18.6% YoY (3ppt higher than the locally calculated figure). In addition, a significant price increase in public parking in Budapest and a widespread raise in service prices by a big telecommunication company from 1 September will give a further boost to inflation.

However, the extent and timing of the peak in price pressure still depend on price caps, which are in place until 1 October. We expect only a gradual phase-out and with that we forecast headline inflation to peak in the 22% YoY region by the end of this year. However, should the government scrap the price caps in one go, this could result in an above 20% inflation print in October. On average, we forecast a 14% headline reading in 2022, with 15% inflation in 2023 as the carry-over effect which will give a massive boost to next year’s reading. We only see inflation coming down to 3% in the second half of 2024.

Hungarian central bank to continue tightening

As far as monetary policy is concerned, we see no change. Although a central bank typically should not react to discretionary price shocks (such as changes in administered prices), this needs to be seen through a different lens nowadays. There is a major threat that inflation expectations will remain permanently high, strengthening wage-push inflation. To break such second-round effects, policymakers need to keep their foot on the gas pedal. The central bank needs to continue to raise interest rates – but with the newly announced liquidity-draining measures, the effectiveness of hikes could increase. In this respect, we see an opportunity for lowering the step sizes to 75bp for the next couple of months. We still expect a terminal rate of 14%, reached by the end of the year with a gradual slowdown in the tightening cycle.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap