How Petro FX could react to the OPEC meeting

In short: there's limited upside, only downside

Hamza Khan, ING’s Head of Commodities Strategy, notes that while initial plans were to discuss a 3-to-6 month extension, the conversation now seems to be centred on a 9-month extension (until March 2018). Oil markets have already priced this in.

Bar headline driven volatility, the meeting should be a formality for petro FX. A bigger story was the fact that the rest of the commodity universe had been catching a (potentially unrelated) bid after a tough couple of months; both AUD & NZD were the outperformers in the G10 FX space this week prior to the sharp reversal in Asia overnight. The combo of higher metals, a ‘flight-to-quality’ yield and a short positioning adjustment may have all been valid contributing factors.

The meeting should be a formality for petro FX

But for the AUD$, the China downgrade – and its possible knock-on effects for steel prices – highlights the fickle nature of chasing short-term upside in commodity FX (without a positive local story).

Overall, oil markets are gradually moving towards a more balanced level – but the path seems to be much longer than anticipated and riddled with short-term obstacles. This does not bode well for any lasting commodity FX impact. We think the focus should remain on idiosyncratic fundamentals; RUB & COP are those that remain sensitive to oil.

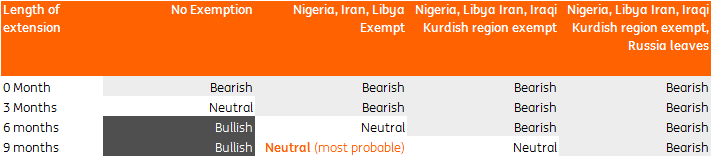

Possible outcome scenarios for the OPEC meeting

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap