Good US jobs report is clear positive for the Fed

Strong wage growth is key takeaway from July's US jobs report. Throw in decent inflation next week and markets might start tentatively re-aligning with Fed dots

Trio of good news from the US jobs report

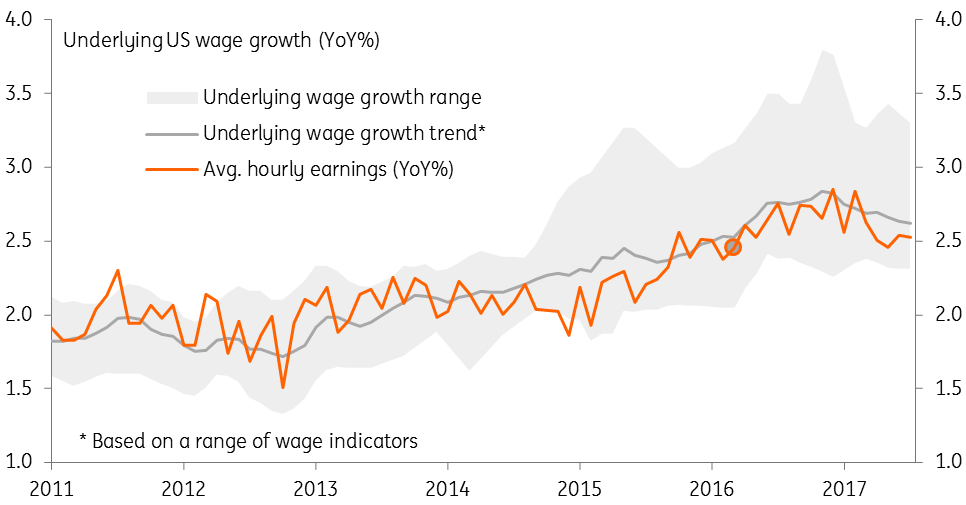

The US labour report shows payrolls rose 209,000 in July versus expectations of a 180k gain. The net revisions were up 2,000 so a very good outcome given the economic environment. Unemployment fell to 4.3% from 4.4%, as expected, while underemployment remained at 8.6%. There was also good news from wages. They rose 0.3%MoM – the strongest increase since February – which kept the annual rate of growth at 2.5%.

| 2.5% |

Average hourly earnings (YoY%) |

| Better than expected | |

Strong inflation next week might tempt markets into pricing in more hikes

This is a positive story, but one month of stronger wage growth is not going to sway the market in terms of its thinking for Fed policy. However, next week will see the release of the PPI and CPI reports and both look set to show an increase in inflation pressures. The market is currently looking for headline PPI to rise to 2.3% from 2% (core PPI to rise to 2.1% from 1.9%) while next Friday’s CPI report is predicted to rise to 1.8% from 1.6%.

Wage growth has struggled to gather pace recently

We expect the next Fed hike in December

This combination of stronger wage, producer and consumer price inflation could nudge the market into thinking that its pricing of only one rate rise over the next 18 months may be too cautious. With the activity backdrop looking reasonable and the economy adding jobs in significant numbers we are looking for a December Fed rate hike followed by two further moves next year.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap