GBP: Bank of England’s Brexit risk premium

While the pound might have got dumped by its ‘unreliable boyfriend’ today, we expect it to come crawling back, at some point

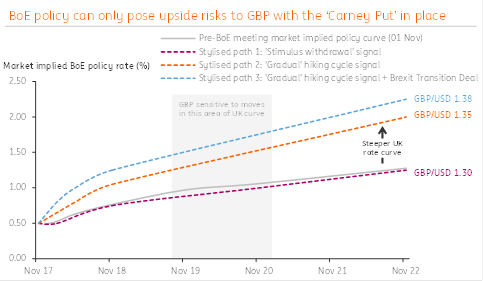

For now, it appears that policy tightening assumptions remain cautious due to what can be described as a ‘Brexit risk premium’. So the chain of logic remains: Brexit progress = a steeper UK rate curve = GBP upside.

• GBP's circa 1% knee-jerk move

We attribute the pound’s circa 1% knee-jerk move lower, to markets pushing back their expectations for additional Bank of England rate hikes. Although the overall level of tightening priced in has returned back to where it had been on average over October. The market-implied BoE policy rate in three years’ time is now at 1.00% - which we deem appropriate relative to BoE’s message today.

• The binary ‘Deal or No Deal’ Brexit risks

The binary ‘Deal or No Deal’ Brexit risks makes it understandable as to why this may have been initially perceived as a one-and-done type of reaction – even though the Bank’s official guidance gave nothing to this sort. The Bank’s fairly laissez-faire forward guidance, in fact, retains an element of policy flexibility.

• Debates over the timing of the next rate hike

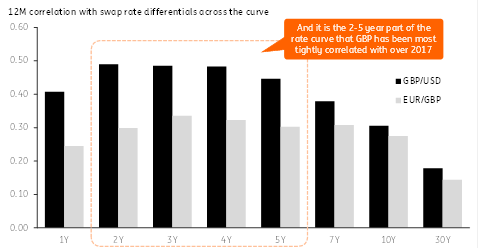

The debates might continue to give us some small movements in GBP over the near-term but these are just semantics for the broader outlook for GBP. When it comes to BoE policy, the bigger driver tends to be the overall level of tightening priced in over the two or three-year part of the curve (see Fig 2 below) – and this remains data, and more importantly, Brexit-dependent.

• We see upside risks here based on our assumptions for Brexit negotiations

Here our motto is ‘small steps are way better than no steps’. We see progressive steps agreed Brexit transition deal as providing cyclical support to GBP – in particular it would reduce some the medium-term uncertainty keeping economic activity on hold, allowing potential upside revisions to 2018/2019 UK GDP growth and in the context of the BoE – this would add a couple of rate hikes to our tightening cycle assumptions.

•Bottom line

We continue to see upside risks to sterling with the 'Carney put' now in place. Speculation of additional Bank rate hikes will continue to act as a buffer to the currency. Plus – with the Bank retaining its optimism over wage growth dynamics and underlying inflationary pressures – we think markets may be underestimating the role of the pound in the Bank’s policy thinking.

In particular, the November Inflation Report acknowledges there are still some lagged inflationary effects yet to feed through from GBP’s post-Brexit depreciation – and this is proving to manifest, slower than anticipated.

ING’s GBP/USD targets under various tightening cycle assumptions

FX outlook

Based on our Brexit assumptions, we view today’s dovish BoE re-pricing – and subsequent move lower in GBP/USD – as a slight overreaction. The next near-term catalyst will be 2017 Autumn Budget (22 Nov). Though the Chancellor’s hands may be tied by weaker OBR forecasts, some modest headline fiscal easing to support the UK economy may also be a factor that nudges short-term UK rates higher.

Overall, we don’t see today’s BoE decision as a risk to our GBP/USD forecast of 1.35 by year-end. We look for the 100-dma (1.3080) to provide near-term support – and a hold of this would be supportive for our constructive GBP outlook.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap