French public deficit below 3% for the first time in ten years

French public deficit was 2.6% of GDP in 2017 - the lowest it has been since 2007. The budget has mainly been helped by the economic recovery in 2017 but fiscal measures should bring the deficit closer to 3% of GDP again in 2018

| -2.6% |

Budget deficit in 2017Percentage of GDP |

Higher growth and low interest rates are good for debt stabilisation

The French economy grew twice as fast in 2017 when compared to 2016 in real terms (and even more in nominal terms) which is used to calculate debt in percentage of GDP.

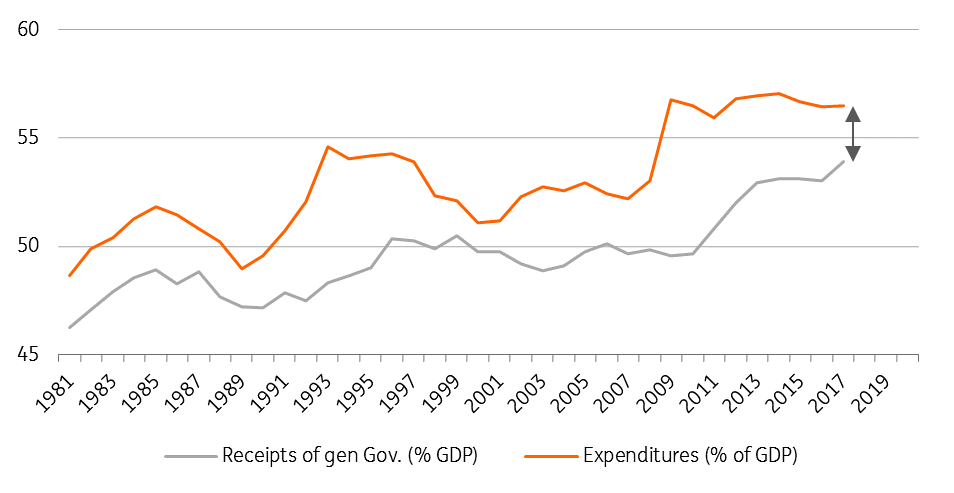

This helped tax receipts to increase by four percent in 2017 while expenditures (outside debt service) increased by 2.7%. This divergence slashed the primary deficit (spread between receipts and expenditures) from 30 to 15 billion euros or 0.7% of GDP. With debt service declining thanks to the low-interest rate environment by 3.7% on the year (to 44.4 billion euros or 1.9% of GDP), the total budget deficit was limited to 2.6% of GDP. Therefore, the increase in total debt was also limited, to 0.4pp of GDP at 97%.

It was expected that the total budget deficit would end up below the 3% GDP threshold in 2017, but such a reduction in the primary surplus was not expected and its possible, it may not last either.

Indeed, as the Government decides to transform the CICE tax credit in structural charge reduction, it should affect expenditures as a percentage of GDP as of this year. The European Commission currently believes it will push the deficit beyond 3% of GDP again.

Higher receipts are closing the gap rather than lower expenditures

Given that the growth prospects are currently better (we expect 2.2% GDP growth for France this year) and that debt service should continue to decline this year, we think that the deficit could still be limited to 2.8% of GDP in 2018.

For 2019, we believe that it will stabilise below that level, allowing the gross public debt to stabilise as a percentage of GDP. Therefore we don't believe that the French debt will reach 100% of GDP before 2020.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap

26 March 2018

In Case You Missed it: One year to go This bundle contains 7 Articles