France: Manufacturing sector growth slows down

Two major indicators of business confidence in September have been published today and they both point to the same conclusion: economic growth is slowing down in France, particularly in the manufacturing sector

Supply difficulties weigh on the industrial sector

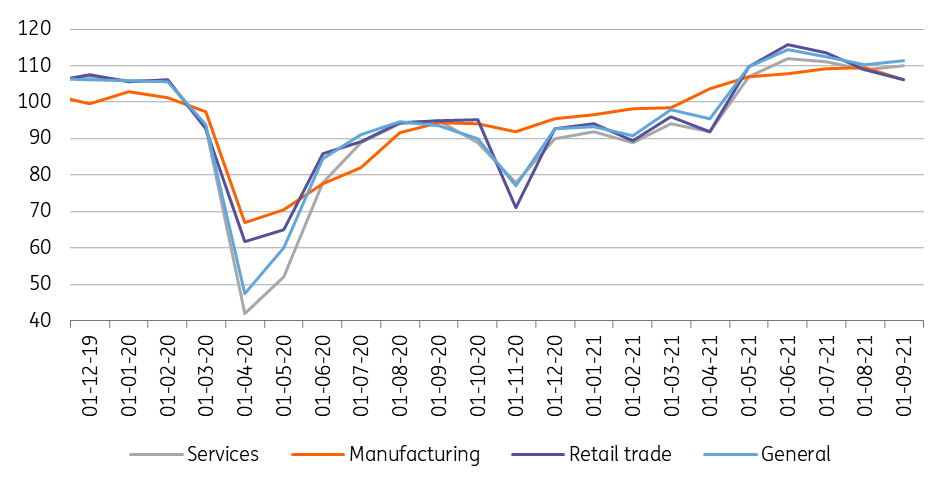

The business climate in industry, as measured by INSEE, fell more than expected in September to 106 from 110 in August, due to a drop in sentiment on production over the last three months and on future production in almost all sectors of the French economy. The indicator is at its lowest level in five months and the same as the last lockdown. It is interesting to note that manufacturers' assessment of foreign order books fell sharply and even fell below the long-term average. This illustrates the overall slowdown in global economic growth and the continuing difficulties on production lines, which are limiting demand for and the production of industrial goods, particularly in capital goods. The decline in foreign order books is also being negatively impacted by the current difficulties in the automotive sector, which is facing a worsening semiconductor shortage that is forcing companies to shut down temporarily.

The business climate in industry fell more than expected in September

Meanwhile, the Markit PMI for the manufacturing sector, which stood at 55.2 in September compared with 57.5 in August, is the lowest in eight months. The indices again point to an increase in supplier delivery times. Delivery times are now at an all-time high and are explained, according to the responding companies, by shortages of raw materials and components, transport and port closures in Asia, combined with strong demand.

PMI indices indicate that growth is slowing

Rising inflation expected

These supply difficulties are leading to higher prices paid by manufacturers, which should be passed on to selling prices, pushing up inflation from September and probably for the next few months as well. We believe that this effect will be more than temporary, and that higher inflation should be passed on, in part, to wages, thus prolonging the period of higher inflation. Because of its 70% nuclear-based energy mix, France is nevertheless less prone to the risks of sharply higher inflation during the winter than are other European countries that rely heavily on gas.

A service sector that is doing well

In the services sector, the business climate is doing better and even increased in September to 110 (from 109 in August). Business leaders are more optimistic, particularly with regard to activity and the demand forecast for the next three months. This illustrates that the services sector is doing well and will probably be the engine of French economic growth in the third quarter. After months of restraint where household consumption has focused on consumer goods, the second half of 2021 will see a shift in consumer demand towards services. However, the peak of this shift probably occurred during the summer and the growth of demand for services is already declining, as illustrated by the Markit PMI for the sector which stood at a very high 56.0 in September, but down from 56.3 in August.

Normalisation at the centre of the outlook

After an excellent first half of the year and a very good summer, the peak of growth has passed in France and growth is now slowing down. We have entered a new phase, that of normalisation after the post-lockdown catch-up. This does not mean that we should be pessimistic, after all France should easily exceed 6% growth this year, but it does imply that the limits and risks will become increasingly apparent in the coming months. Among these risks, the most important at the moment seems to be that of supply difficulties. But other risks such as inflation or recruitment difficulties are not negligible either.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap