‘Forthright’ Federal Reserve set to stick with 75bp rate hike

There is nothing in Fed Chair Jerome Powell's comments to suggest an imminent moderation in the pace of rate hikes. The need to 'act now' to get a grip on inflation in an environment where the economy is experiencing decent growth, strong job creation, and a likely rise in core inflation next week points to a third 75bp hike on 21 September

Another 75bp in an environment of strong growth and rising core price pressures

Federal Reserve Chair Jerome Powell’s comments to the Cato institute’s conference today on monetary policy are clearly supportive of a third consecutive 75bp interest rate hike on 21 September. There is no hint that he supports moderation, arguing that “we need to act now, forthrightly, strongly as we have been doing and we have to keep at it until the job is done”. There is also the usual mention of inflation expectations and the need to anchor them in order to ensure inflation doesn’t become ingrained.

The latest data certainly backs the case for 75bp with business surveys looking robust, the labour market continuing to create jobs in significant numbers, and next week’s inflation numbers set to show core CPI accelerating to 6.1% from 5.9%. Moreover, the third quarter is shaping up to be quite a strong one, fully reversing the declines seen in GDP in the first half of the year.

Inventories and net trade are swinging back and set to make decent positive contributions to headline growth. Meanwhile, consumer spending is being boosted by the lift in spending power from lower gasoline prices. High-frequency data over the Labor Day holiday show restaurant dining at record levels, while air passenger travel over the past weekend exceeded that of 2019 for the first time, so 3% growth looks to be on the cards.

High-frequency data point to strong 3Q consumer spending

Nonetheless, the deteriorating global outlook and weakening domestic housing market combined with the cumulative impact of policy tightening and the strong dollar means we think the Fed will moderate its hiking to 50bp in November and 25bp in December. Weaker wage pressure and more limited month-on-month increases in CPI thanks to lower import and other input costs would certainly help this argument.

Rate cut chances remain high for 2023

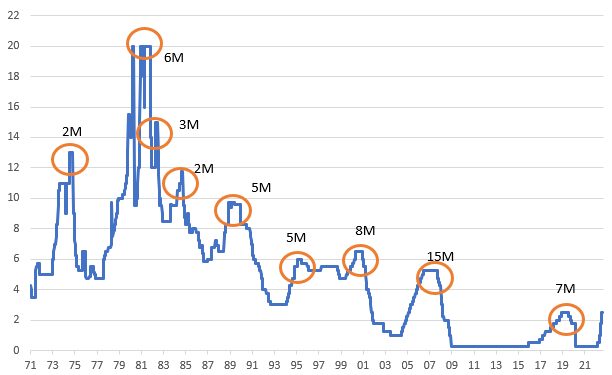

Chair Powell has also reiterated the view that the market shouldn’t get too excited about pricing rate cuts next year, saying “history cautions strongly against prematurely loosening policy”. However, as the chart below shows, over the past 50 years, there is typically only a six-month gap between the last rate hike in a cycle and the first rate cut – not exactly a long gap. It seems to us to be more of an effort to nudge the longer end of the Treasury yield curve higher to ensure financial conditions remain tight.

Fed funds rate: timeframe between last rate hike and first rate cut

With recessionary forces intensifying, we expect inflation to fall relatively swiftly next year thanks to lower gasoline prices feeding through more broadly, weaker wage pressures and declining input costs combined with falling house prices depressing the rental components of CPI. We are currently pencilling in a rate cut in June with further easing through the second half of 2023.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap