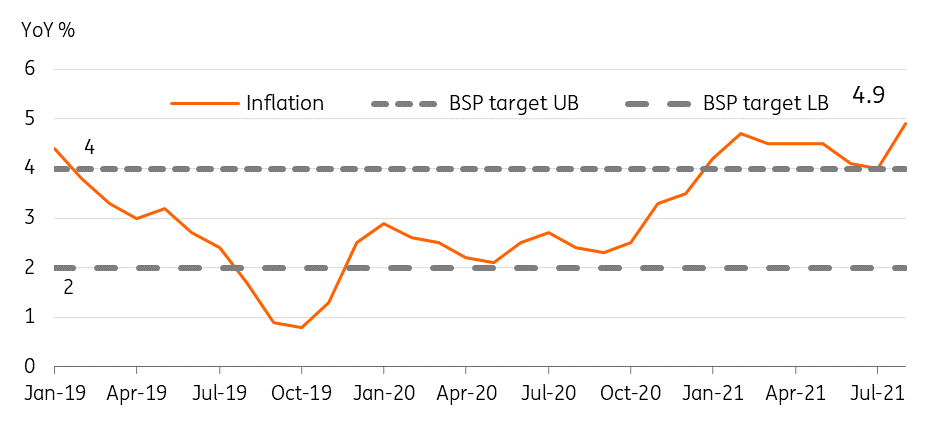

Food price spike pushes Philippine headline inflation above target

Food prices accelerated in August forcing headline inflation past the central bank’s target of 2-4%

| 4.9% |

August CPI YoY inflation |

| Higher than expected | |

More expensive food and higher energy costs push inflation to 4.9%

Philippine inflation surged to 4.9% YoY in August driven by a 6.5% spike in food costs due to crop damage from recent storms. The food component accounts for roughly 32% of the CPI basket and contributed more than 53% of the 4.9% headline inflation number. Higher imported energy prices also helped drive the acceleration in inflation - utility and transport prices rose 3.1% and 7.2% respectively.

Demand-side pressure on inflation was likely muted given that most of the country was under strict mobility restrictions during August as Covid cases surged due to the Delta variant. YTD inflation is now at 4.4%. And the headline number will likely stay above 4% in September.

Philippine inflation breaches target again in August

Central bank likely to look past cost-push break again

Bangko Sentral ng Pilipinas (BSP) will likely look past this price spike. BSP Governor, Benjamin Diokno, continues to vow support for the fledgling economic recovery. Elevated inflation will likely sap some momentum from household consumption in the near term. Consumption accounts for roughly 70% of total economic activity in the Philippines. We expect elevated inflation and the recently recorded 6.9% unemployment rate to weigh on the Philippine economic recovery. We forecast full-year GDP to slide to 3.8%, below the official government estimate of 4-5%. The peso will likely remain pressured in the near term as BSP has signalled that it will not likely adjust policy rates to combat this current spike in prices.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap