Fed unveils plan for very steady balance sheet changes

Alongside a 25bp rate hike, the Fed outlined the details of its plan to very gradually stop reinvestment of Treasury and MBS holdings

The Federal Reserve has delivered a 25bp rate hike, as widely expected, and indicates that it continues to think another rate rise is probable before year-end.

The “Fed dots” diagram shows that FOMC members expect the fed funds rate to be 1.25-1.5% for end 2017 before rising to 2-2.25% in 2018 with the longer run figure remaining 3%. These are the same as their last forecast update in March.

But markets aren't buying it. Fed fund futures suggest another rate rise this year has barely a 50:50 chance, and there is little further policy tightening priced in for 2018.

Fed still looking for another hike this year

In the accompanying statement the Fed reiterated that they continue to believe “economic activity will expand at a moderate pace” with the risks to this assessment appearing “roughly balanced”. They do acknowledge the recent softness in inflation stating that it will “remain somewhat below 2% in the near term, but [will] stabilize around 2% over the medium term”.

A September hike will require further evidence of wage growth

This positive assessment is borne out in their economic forecasts with 2017 GDP revised up a tenth of a percentage point to 2.2% while 2018 and 2019 were left unchanged.

But with little sign of tax reform and fiscal stimulus on the horizon and inflation rates declining rather than rising, markets will remain sceptical on the Fed’s assessment of the likely path of interest rates. We are still predicting an interest rate rise in September, but this will require further evidence that labour market tightness is generating higher wage growth.

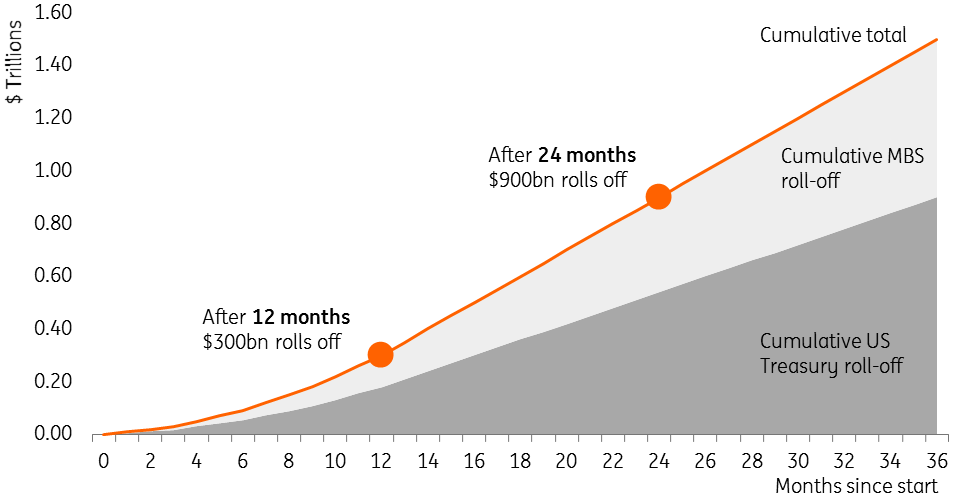

But the real fireworks today came in the form of more details on the Fed’s balance sheet reduction plans. They state the Fed expects “to begin implementing a balance sheet normalization program this year, provided that the economy evolves broadly as anticipated”.

| $6bn |

Initial pace of reduction in Treasury holdings |

How the balance sheet will unwind

In terms of Treasuries, the Fed anticipates a cap of $6bn per month, increasing in steps of $6bn at 3M intervals over 12 months, until it reaches $30bn. For agency debt & MBS it will start out with a cap of $4bn, rising by $4bn every three months until it reaches $20bn in 12 months. The FOMC suggest these caps will remain in place until the Fed are holding “no more securities than necessary to implement monetary policy efficiently and effectively”.

Given the Fed’s balance sheet is $4.5 trillion, this is a very cautious approach.

This is understandable given the experience from the “taper tantrum” and this pace of reduction indicates that the Fed is happy for the economy to effectively grow into a large Fed balance sheet, reducing the need for them to offload assets.

This is consistent with the Fed’s assertion that “changing the target range for the federal funds rate is the primary means for adjusting the stance of monetary policy”. Unsurprisingly, the US Treasury market is reacting positively to this news.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap