Czech Republic: Weaker both industry and retail sales

February industrial production disappointed by decelerating to 2.7%, mainly as a result of stagnation in the automotive industry. Car sales also fell in YoY terms in February, perhaps due to some technical reasons

Weaker industry due to manufacturing segment

Industrial production (IP) growth reached 2.7% year-on-year in February, and ended below the market consensus and the January print of 5.5%. Although electricity production and mining and quarrying fell in YoY terms, their contribution to the IP slowdown was lower than 1ppt. As such, the main reason for the weaker print was the manufacturing segment, mainly the car segment, which stagnated in YoY terms in February after double-digit growth in 2017.

| 2.7% YoY |

Industrial production in Februarydissapointed due to weaker growth in the car segment |

| Worse than expected | |

Deceleration in the automotive segment likely to continue

Motor vehicles segments is gradually decelerating after double digit-growth rates in the last four years. Thus, the two-digit growth of the automotive sector is most likely over due to a high base, capacities constraints and also a weaker dynamics of new orders, which are also broadly stagnant on average. This is the reason why we expect industrial production to decelerate close to 4% this year after its solid almost 7% growth in 2017. Still, the shape of industry is good, seeing solid new orders in other important industrial segments.

February retail sales remain positive

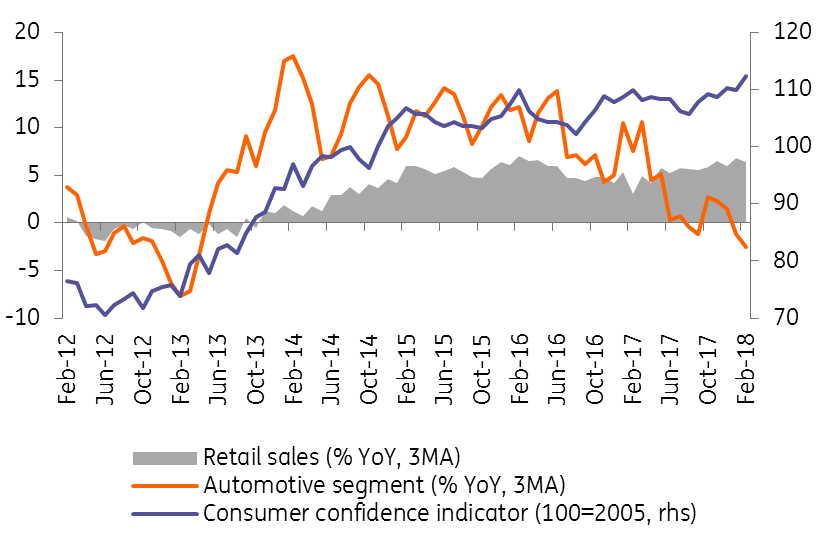

Retail sales (excluding the automotive segment) increased by 6% year-on-year in February, surpassing the average of last year's 5.4%. Growth in food sales continues at a moderate pace of around 3%, while growth in non-food goods continues to grow at a solid pace of close to 10%. In February, dynamics slowed somewhat from January's 12.3% to 9.1%, but still remained strong.

Retail sales and confidence indicator

Car sales fell, technical reasons might have a role

On the other hand, sales of motor vehicles has been gradually decelerating in last year, and the latest figures from the beginning of this year confirm this trend further. Motor vehicle sales even fell by 5% year-on-year in February. This is the weakest year-on-year figure since March 2013. On the other hand, the sales slowdown may also be driven by weaker re-exports of cars. Indeed, anacdotical evidence suggests that the CNB FX-floor regime led to a practice in which many cars were registered in the Czech Republic, but then immediately re-exported to Germany with reasonable profit due to the weaker CZK. As a stronger CZK ended this motivation, new registration of cars in the Czech economy might partially decelerate due to this reason.

Household consumption main growth driver this year

All in all, retail sales excluding cars are still positive-looking at the beginning of this year, confirming that the consumer sentiment of households remains strong, driven by very favourable developments in the labour market. Household consumption will thus be among the main factors for the growth of the domestic economy this year.

Download

Download snap