Czech Republic: September inflation below expectations

Czech inflation slowed slightly to 3.2% in September, which was below market consensus and the central bank forecast. The main reason was lower food prices, but CPI remains above the central bank target and offers limited reason for further monetary policy easing

Food prices behind CPI deceleration

Inflation slowed to 3.2% YoY in September while the market expected an acceleration to 3.5% and the central bank expected it to rise to 3.6%.

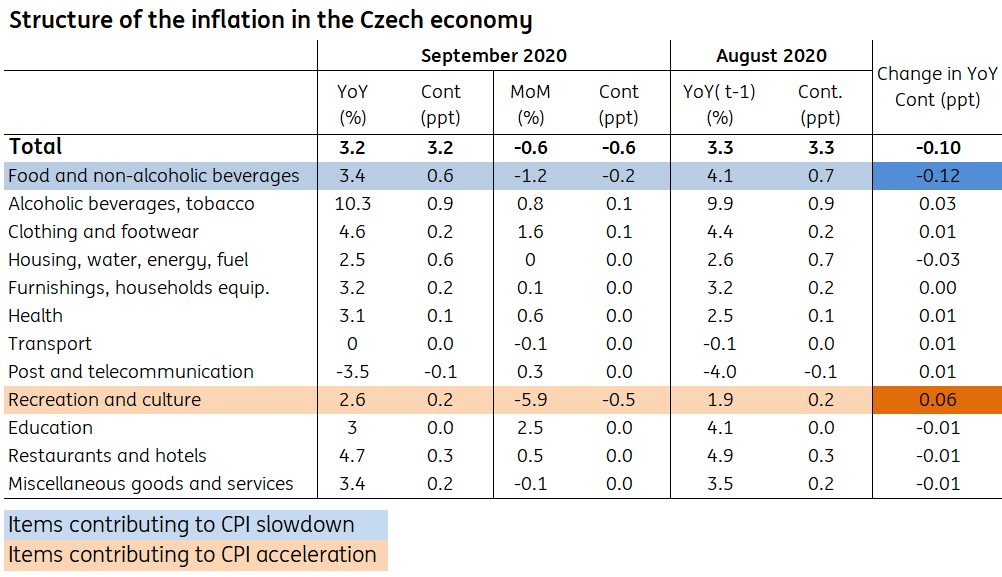

The slowdown was mainly due to food prices, which fell by 1.2% month-on-month, while preliminary values had indicated an increase in line with typical seasonality. As such, year-on-year growth in food prices slowed from 4.1% to 3.4% and the contribution to YoY inflation fell by 0.12 percentage points compared to August, thus largely explaining the CPI slowdown in September.

However, alcoholic beverages and tobacco prices, as well as recreation and culture, contributed slightly to YoY CPI growth in September. Although holiday prices fell sharply compared with August due to the end of the season, their YoY growth accelerated slightly compared with August (see table below).

| 3.2% |

September CPI YoYafter 3.3% in August |

| Lower than expected | |

Prices of services stagnated at 2.7%, core inflation accelerated

While inflation had been surprising on the upside in recent months, the situation in September was reversed. The main surprise was volatile food prices, which came in above expectations. Services’ prices stagnated at 2.7% YoY as in August, while core inflation in the CNB definition accelerated to 3.7% (after 3.6% in August), and was again above the CNB’s forecast.

As such, we can't speak of mounting disinflationary pressures given the food factor behind the CPI slowdown, though some categories of services are slowing gradually. Accommodation prices slowed to 0.4% YoY after 1.5% YoY in August, and transport services from 2.3% YoY to 1.2% YoY, but the impact of the Covid-19 crisis on prices appears to have been relatively muted so far (though it might be partially due to a measuring error).

Structure of inflation in the Czech economy

Uncertainties for 2021 inflation persist

Inflation is expected to decelerate further in the coming months, and should be slightly below 3% through to the end of the year, in our view. The central bank expects 3.4% for the whole of 2020, which would be the highest rate of inflation since 2008. However, today's data suggests a slightly lower print, but above 3% nonetheless, and therefore the highest since 2012.

Next year, we expect CPI to slow to closer to 2%, but a number of uncertainties prevail with both pro- and anti-inflationary forces at play, for example, the Covid-19 impact leading to weaker demand versus a planned significant reduction in income tax that could be pro-inflationary.

No unconventional monetary tools likely

Given limited deflationary pressures to date, we don't expect the central bank to implement any unconventional policies, as supported by Governor Rusnok's comments today.

According to the Governor, the central bank doesn’t need to use unconventional instruments to ease monetary policy further because inflation remains above target and banks have sufficient liquidity.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap