Czech Republic: Retail sales surprise on the upside

November retail sales have beaten consensus by accelerating 7.8%, solidly above the 2017 average of 6%

Retail sales accelerated solidly in November

Czech retail sales (excluding the automotive segment) were surprisingly strong in November, with year-on-year growth of 7.8%. This may seem like a modest improvement compared with the more than 6% growth recorded in the prior month but it is worth noting that the October figure was supported by a higher number of working days. When this effect is taken into account, retail sales grew just 3.9% in October. From this perspective, November's number is surprisingly positive and well above the 2017 average growth of 6%.

Sales accelerated both in food (3.3%) and non-food (10.7%), and in both cases were above the year-to-date average. The internet segment, which has been traditionally strong, accelerated by 24% year-on-year.

| 7.8% |

Czech retail sales, Novembersolidly above the 2017 average of 6% |

| Better than expected | |

Weakening car sales bring some uncertaninity

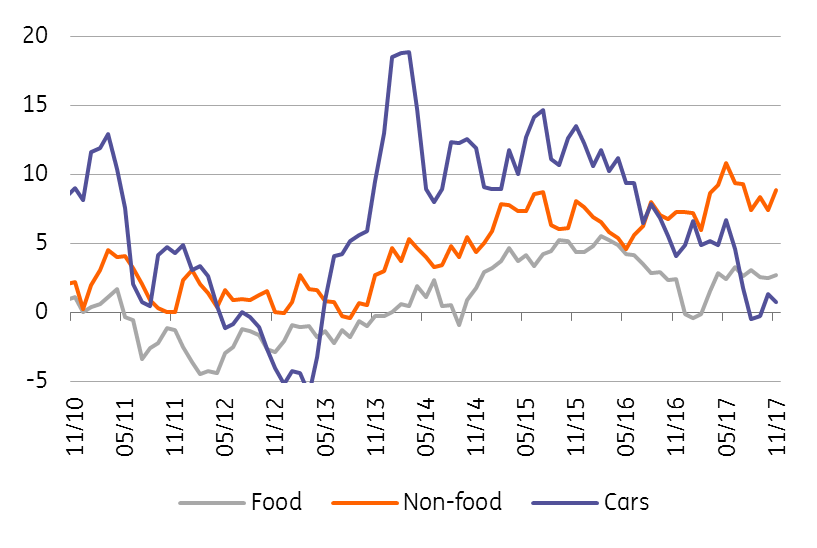

Sales of motor vehicles were somewhat disappointing, falling slightly in YoY terms; they decelerated gradually in 2017 to just 3% YoY, after double-digit growth in 2014-2016. This indicates that domestic demand for new cars might be partially saturated.

Retail sales (%YoY, 3month avg, working day adjusted)

Households consumption should remain the main growth-driver this year

However, November retail sales confirm solid consumer sentiment at the end of 2017 as a result of favourable labour market developments and gradual wage growth. Compared to around 2.6% growth in retail sales in the whole of the EU, sales dynamics in the Czech Republic more than doubled last year, and it was among the six countries in the EU with the fastest growing retail sales. Thanks to an overheated labour market pushing wages up this year, household consumption will continue to be one of the main drivers of domestic economic growth this year and a clear pro-inflationary factor enabling the CNB to gradually tight monetary policy.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap