Czech PMI stabilises in April

Czech PMI remains at its 6-month low in April. Although not a game changer for the central bank, the recent weakness of the CZK increases the likelihood of hikes in the second half of the year

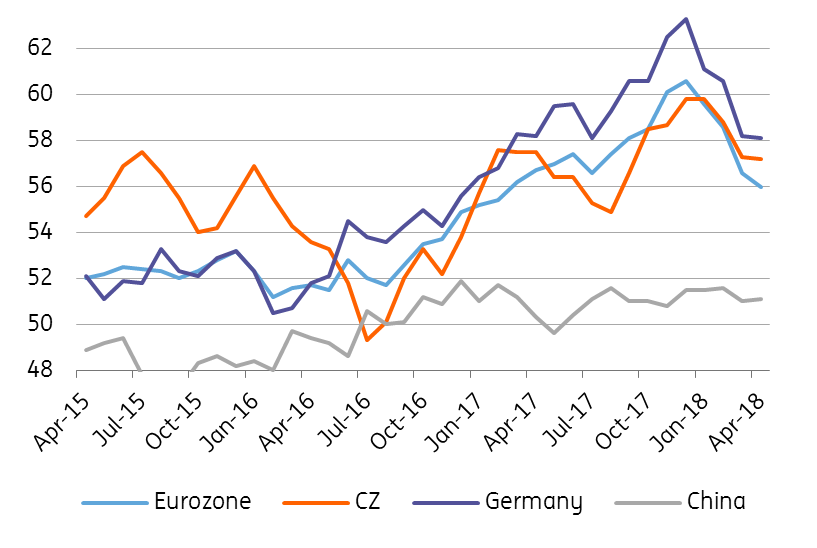

April's Purchasing Managers Index (PMI) in the Czech Republic reached 57.2 points and thus remained at its March level (57.3). As in the case of Germany and the Eurozone, PMI developments stabilised in April, after its two-month decline.

| 57.2 |

Manufacturing PMI6-month low |

| Better than expected | |

New export orders improved in April

According to IHS Markit, production volume continued to grow in April at a solid pace, albeit it was the slowest pace since September 2017.

On the contrary, new orders grew faster than in March, both from domestic and foreign clients. New export orders improved and increased at the highest rate in last three months. Input prices continued to increase due to higher metal prices, though slightly less compared with March. The manufacturers continue to suffer from a shortage of sufficient labour force.

Manufacturing PMIs

April figures still close to the 2017 average

Although PMI moderated slightly in April, it still signals improving conditions in the Czech manufacturing segment. As such, conditions in the industry are better 21-months in a row. And looking at longer-term PMI averages, April value is at the 2017-average and only slightly below the 12-month average, which still makes it positive.

A decline in PMIs and other leading indicators in Germany and the Eurozone in recent months has begun to raise concerns about a more marked slowdown in economic activity in the EU.

But in our opinion, this is still premature as there were a lot of one-offs during the first quarter that might explain the relatively swift slowdown in these soft-indicators (weather conditions, holidays, flu epidemics).

That's why we don't perceive weaker leading indicators so negatively just yet, although we expect a slowdown in Czech industrial activity this year given the high base add stretched capacities. However, on the positive side, April survey indicates an acceleration in new orders, which have been so far relatively weak.

A weaker CZK is increasing the need to tighten rates in 2H18

This isn't a game changer for tomorrow's Czech National Bank meeting, but we expect the intentional continuation of a dovish bias as we believe the CNB wants to sound dovish to avoid monetary tightening via the FX channel, which will provide further room to tighten via the preferred rates channel in 2H18.

As such, the recent weakening of the koruna might be what the central bank wants as it increases a need to tighten monetary conditions via rates in 2H18.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap