Czech Republic: Industry remains solid in November

Industrial production grew by almost 5% year-on-year in November, supported by one extra working day. Though the automotive segment posted double-digit growth again, new orders are still on a weaker footing

Industrial production affected by calendar bias

Industrial production grew by 4.8% YoY in November. One extra working day played a role and adjusting for that, Czech industry would have grown by 1.5% YoY, down from the 3% rate in October, which was also the average growth rate in 2018. The November figure was thus in line with analysts' consensus.

| 4.8% YoY |

Industry growth in November |

| As expected | |

Car production accelerated again

The manufacturing industry itself rose by 5.7% in November (2.0% after adjusting for the calendar bias), mainly due to strong growth in car production, which accelerated by 10% YoY, the fastest pace since April 2018. Since October, the automotive sector and the production of other transport equipment have improved after several weak months, but new orders are still not providing more optimistic prospects for this most important Czech industry.

Total new orders improved by more than 5% in November. Though weaker compared with October, that's still slightly stronger than the average growth rate for the whole of 2018. Still, in the case of the automotive segment, new orders fell in YoY terms, mainly on the back of new foreign orders (-1.8% YoY).

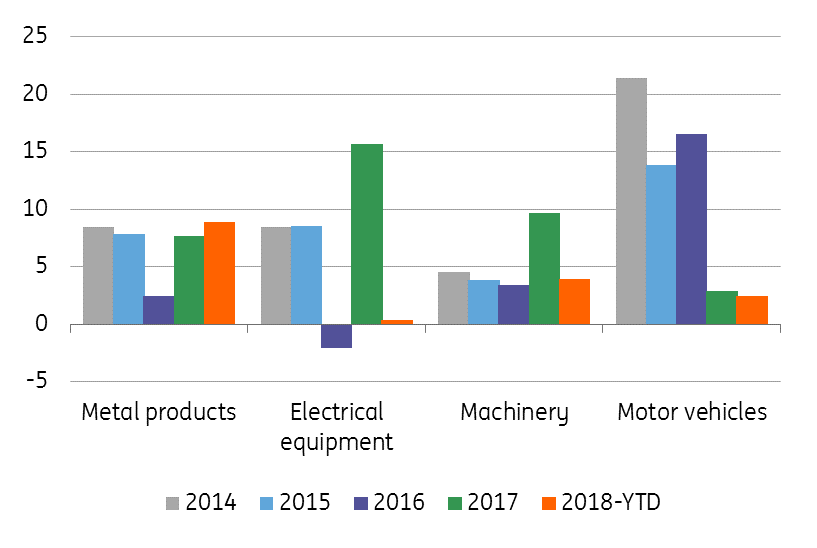

New orders in main manufacturing segments (% YoY)

Foreign demand on the weaker side, as Germany industry indicates

Aside from new orders in the car segment, today's figures from domestic industry seem solid. However, foreign demand is one of the main risks to the future. German industrial growth in November fell by almost 2% month-on-month, the biggest drop since the summer of 2015. While part of the story will be related to the impact of new emission standards in the automotive industry, it is becoming more evident that the problem is also related to the weaker global economy.

2019 outlook becoming more challenging

While domestic industrial production accelerated by 6.5% in 2017 and will grow slightly above 3% in 2018, we see slightly slower growth below 3% this year. Still, the end of 2018 was disappointing in terms of industrial production and global demand, bringing more uncertainty to this year's outlook.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap