Czech Republic: Housing credit still weak amid new income limits

New housing loans improved on a monthly basis in March as a result of typical seasonality. But they remain more than 20% lower year-on-year. Mortgage rates declined slightly last month while interest rates for companies reached a multi-year high. This is no game changer for the central bank and a hike should come this Thursday

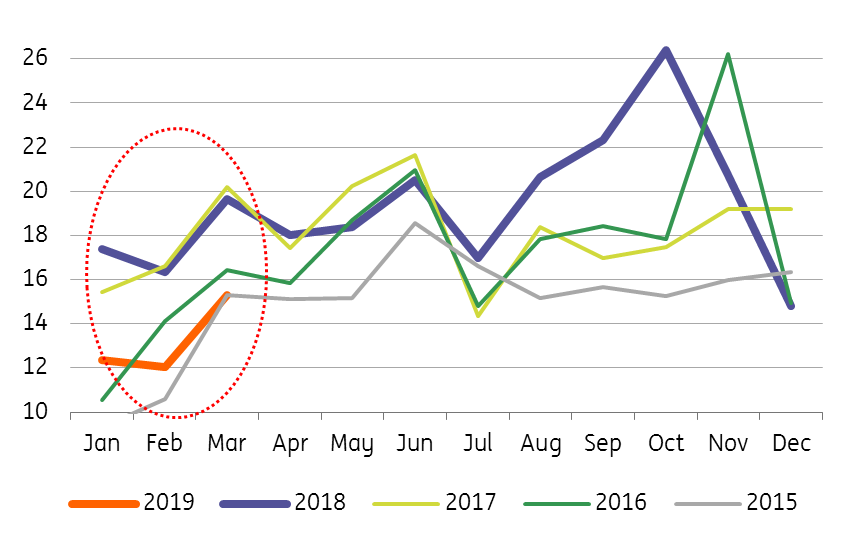

Housing credit remains down in YoY terms

March is usually more favourable in terms of credit activity than either February or January, as the chart below shows. And the same applies this year, with the volume of new housing loans increasing by more than CZK 3 billion month-on-month to CZK 15.3 billion. However, from a year-on-year perspective, the volume of newly-provided loans for house purchases remains more than 20% lower and this is the weakest March figure in the last four years.

New housing loans per month (CZK bn)

Front-loading partially behind the YoY fall

The weakness is partly due to strong front-loading in 2H18 due to new CNB macroprudential limits on household income ratios. New housing loans had been accelerating at a double-digit pace in July-October 2018 before the limits came into force. This has clearly siphoned off some demand from subsequent months. It is becoming more likely, however, that total new housing loans will be below last year's level by more than 10%, which is what the CNB had estimated. This could eventually lead to the easing of some CNB recommendations during the year. This is also suggested by the draft CNB Act, which should replace current CNB recommendations, which proposes partially easing macroprudential limits for applicants up to the age of 36.

Rates weaker for households, but higher for companies

Longer-term maturity interest rates (5Y IRS) have recently declined in response to the uncertain global economic outlook and are roughly half a percentage point below the highs seen in November and October, pushing mortgage rates slightly lower again in March. The most noticeable decrease was seen in new mortgage loans provided by banks (excluding building societies), where the average rate dropped from 3.03% in February to 2.94%. Conversely, interest rates for non-financial corporations loans linked to Pribor's shorter maturities rose to 3.3% in March, which is the highest level since the end of 2010.

No game changer for the CNB

Though today’s credit data does not signal any significant improvement in the Czech mortgage credit market, this is no game changer for Thursday's CNB meeting, as weaker March figures were projected by preliminary data collected from local banks. CNB board members seem to be supporting a further rate hike due to a weaker koruna and higher inflationary pressures, and today’s figures will not change their opinion, in our view. See also our CNB Preview.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap