Czech National Bank: No surprise, rates stability most likely

The CNB kept main rates unchanged, as broadly expected by the market. The press conference confirmed that although the CNB model supports another hike, board members prefer a smoother rates trajectory. This suggests that longer-term rates stability is the most likely scenario, as alluded to by governor Rusnok

In the press conference:

- Domestic economic growth was revised upwards in the new forecasts, from 2.5% for 2019 and 2.8% for 2020 to 2.6% and 2.9% respectively

- Average inflation was revised upwards, from 2.7% for this year and 2.1% for 2020 to 2.8% and 2.3%. The increase in the inflation outlook for next year was mainly linked to the rise in indirect taxes.

- The CNB board assessed that the balance of risks to the forecast at the monetary policy horizon is slightly anti-inflationary. The risk of a more pronounced slowdown in demand growth in the Czech Republic’s main trading partner countries is the main reason for this.

| 2.0% |

CNB 2-week repo rateno change as expected |

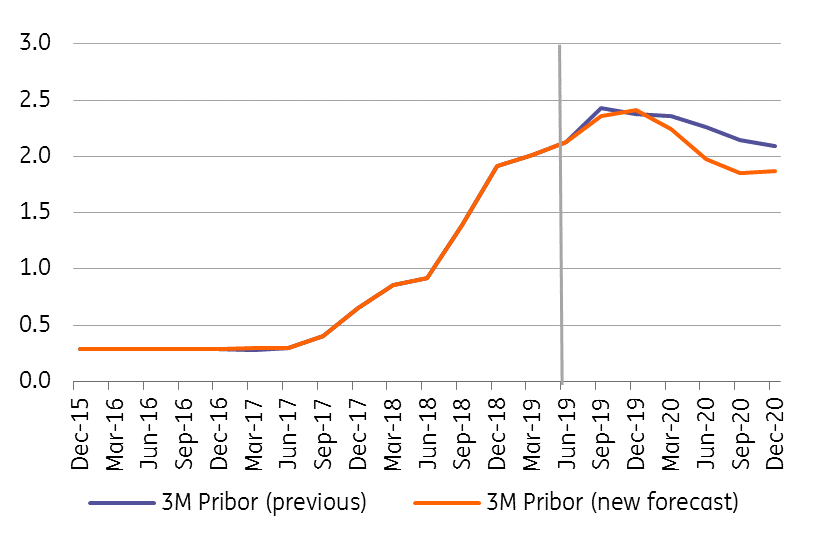

The CNB's 3M Pribor rate (%)

One more hike penciled in for this year

The new CNB forecast pencils in a higher 3M Pribor trajectory this year, expecting 3M Pribor to be at 2.4% in 4Q19 - consistent with one more hike from the CNB this year. Countering this, the rates trajectory falls next year, to 1.9% in 4Q20 (vs. 2.1% expected in the May forecast), suggesting a rate cut soon after any potential increase.

Smooth rate trajectory preferred

Although the official forecast indicates a possible rate hike, governor Rusnok admitted that the CNB board had decided not to be overly proactive and considered it more appropriate to smooth rates - its model suggests a decline next year. This means that inflation might remain above the CNB's 2% target for slightly longer, but the board did not see any partilular risk stemming from this scenario. At the same time, governor Rusnok admitted that he sees no fundamentals supporting any rate cut being priced in by the market to reflect negative global developments.

Long-term rates stability the most likely scenario

All in all, despite the tone of today's meeting being relatively hawkish, chances for further rate hikes are now rather lower thanks to the Board's willingness to smooth rates. Unlike at the June meeting, the CNB board's decision today was unanimous. Governor Rusnok confirmed that the most likely scenario is now longer-term stability of CNB rates, which is in line with our expectations. Unless the global economic outlook improves, CNB will stay on hold in our view.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap