Czech mortgage market continues to fall in February

With the introduction of stricter CNB rules for mortgages in October last year and the resulting frontloading of loans, new mortgages are down almost 30% YoY over the last 3 months.

Weak housing credit for the third month in a row

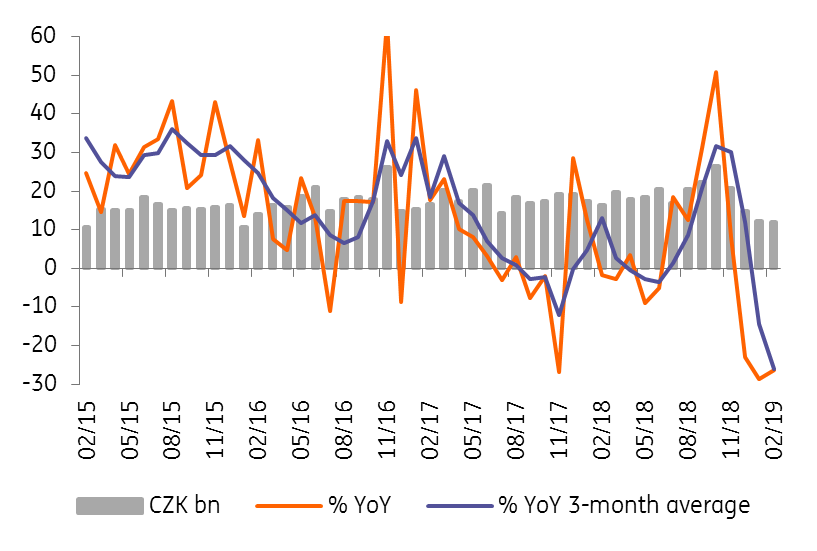

February banking statistics released by the Czech National Bank (CNB) today confirmed a further significant decline in new housing loan dynamics. The volume of new housing loans declined 26% YoY (after -29% in January and -23% YoY in December), to reach its lowest level since January 2016.

New housing loans

Frontloading behind the decline, but only partly

The weak dynamics are partly on the back of strong frontloading in 2H18 due to new CNB macroprudential limits focusing on household income ratios. New housing loans had been accelerating at double-digit pace in July-October 2018, before the limits came into force. This clearly has siphoned off some demand from subsequent months.

Decline this year might be stronger than expected

While the frontloading effect will gradually die out, it is becoming more clear that new housing loans will decline by more than 10% YoY this year due to the combination of high property prices, higher mortgage rates and new CNB income limits. Such a decline might be stronger than the CNB anticipated or demanded , something which could eventually lead to a slight softening of CNB macroprudential rules – most likely in terms of DSTI ratio (debt-service to income ratio being set at 45% for now).

Frontloading also affected property prices at the end of 2018

Strong frontloading in 2H18 also pushed property prices further up. These accelerated by 10% YoY in 4Q18, according to the House Price Index released by the Czech Statistical Office today. However, this acceleration in prices has been temporary in our view and we expect property prices to slow significantly this year. This means that financial stability considerations will have lower importance in further CNB monetary policy setting as macroprudential tools become more relevant in the Czech credit market.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap