Czech inflation hits five-year high

October CPI climbed to the highest rate since 2012 beating consensus but still in line with the central bank estimates

Stronger inflation driven by food prices

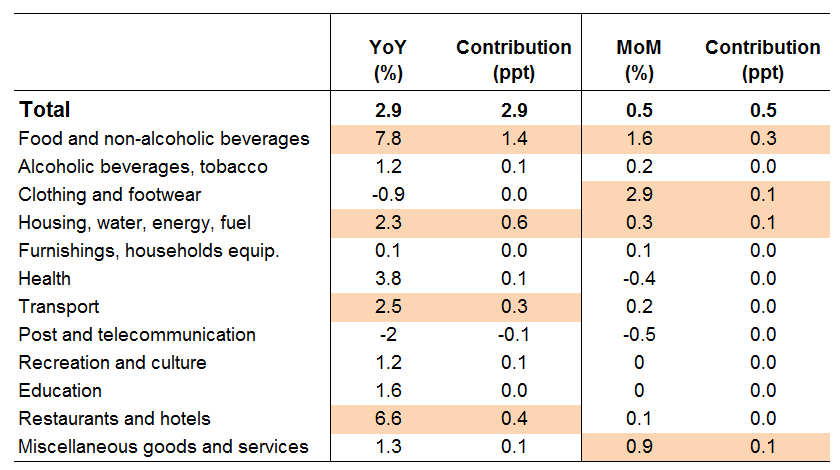

October CPI climbed to 2.9% YoY, the highest level since 2012 when prices grew slightly more than 3% year-on-year. The main reason behind the strong October CPI numbers was food prices that accelerated by 1.6% month-on-month, and their YoY dynamics reached 7.8%. This is also the strongest year-on-year growth since the end of 2012.

| 7.8% |

Food price dynamics (YoY)The main driver of inflation in October |

CPI expected to slow down

In the forthcoming months, inflation will slightly slow down. This will be the statistical effect of a higher base, as prices start to accelerate as a result of higher food prices and restaurant prices in last November. However, the expected slowdown of the YoY figure will be lowered by higher fuel prices which means inflation in the next two months will be only slightly below today's figure.

Structure of the inflation in the Czech republic

| 3.2% |

Growth in prices of services (YoY)Indicating broad-based inflationary pressures |

Inflationary pressures support further monetary tightening

The average inflation this year will get to 2.5% (vs 0.7% in the previous year). In the next year, despite a higher base, it should remain at a similar level, driven by favourable household consumption supported by stronger wage dynamics.

Their growth should pick up by more than 8% next year, which will be a clear pro-inflationary factor. This indicates that inflationary pressure should remain strong, which supports further monetary policy tightening. In our view, the Czech National Bank will continue gradual hiking despite its latest forecast assuming only one hike in 2018.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap