Czech confidence falls slightly in January

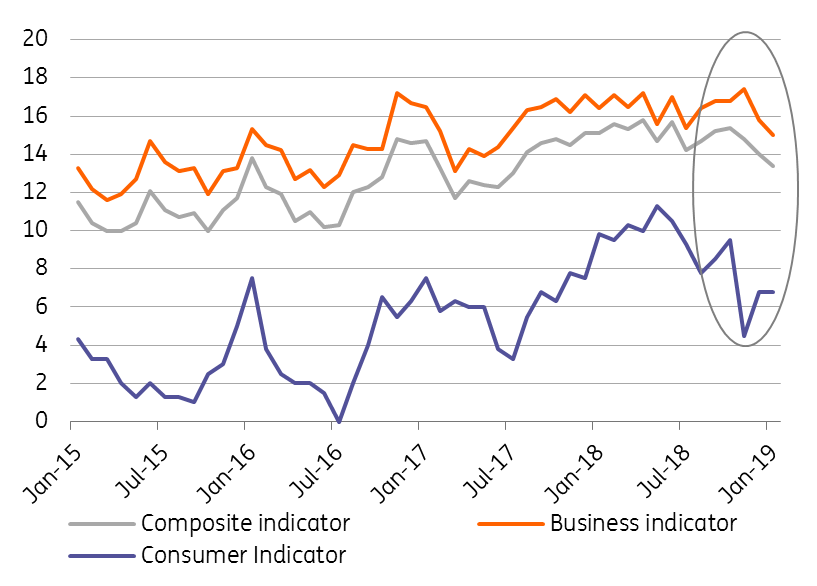

Total confidence in the Czech economy declined slightly in January on the back of weaker confidence in the business sphere while household confidence stagnated, as concerns about the economic outlook persist

Consumer confidence remains weak but still solid in the long-term

Consumer confidence stagnated in January, and despite an increase in December, this still did not compensate for a significant decline in November. As such, confidence remains at the lowest level in a year. Czech households are generally more concerned about the potential economic weakness and higher unemployment rate over a one-year horizon. Although confidence was below the one-year average, it is still relatively high in the longer-term. Households continue to benefit from rising wages and the overheated labour market, and their consumer appetite will probably not change too much. This is illustrated by the fact that the sub-indicator capturing household expectations about their own financial situation continues to remain close to historical highs.

Confidence Indicators (SA, diffusion ind)

Confidence among business influenced by weaker future prospects

Business confidence declined slightly in January driven by all segments except construction. This is also the only segment where confidence is at the highest level in a year, while in industry, services and retail trade, it remains below the one-year average. While an assessment of these business segments regarding the current economic situation or current demand remained broadly stable, confidence declined due to worsening expectations about the months ahead. So worries about the economic outlook are pushing down confidence but the current assessment is not deteriorating sharply and for example, work should be secured for 8.5 months in the manufacturing industry, a similar amount to earlier quarters.

The CNB likely on hold in February due to uncertainity

Though today's confidence indicators have not significantly worsened compared to the previous month, they did not offer any comfort in the current uncertain environment either. From this point of view, the arguments supporting a more cautious approach in monetary policy tightening persists. This was also suggested by the new board member and former Chief Economist of the Czech National Bank (CNB), Tomas Holub, yesterday. He suggested that a weaker-than-expected koruna is an argument for further rate hikes but a worsening global outlook, together with anti-inflationary oil prices, argue against such a move. As such, the February meeting might not bring a rate hike, in his view, and the CNB might remain on hold for a while.

Although we believed a February hike to be very likely due to a weaker CZK, yesterday's signal from the CNB pushed the market, and ourselves, to re-evaluate expectations. An 'on-hold' decision from the CNB next month seems more likely now due to the uncertainty stemming from the global economy but we still believe two more hikes will be delivered by the central bank this year.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap