Czech confidence fell to six-year low in February

Confidence in the domestic economy fell slightly more in February, driven both by weaker consumer and business confidence. It reached the lowest level in the last six years

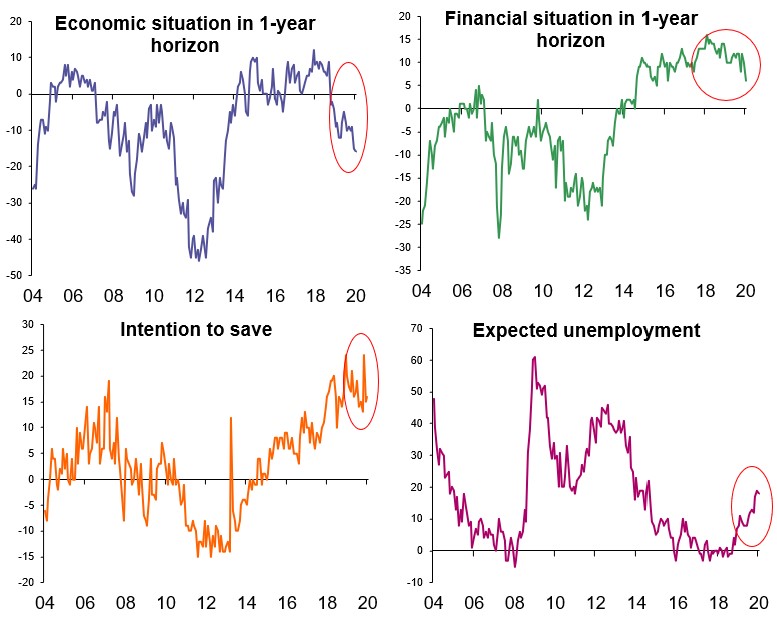

Czech confidence fell slightly in February amid both weaker consumer and business confidence. While the fall in consumer confidence was relatively small, the data breakdown showed a stronger decline in the expected financial situation of households. This sub-indicator has been relatively flat in recent years, supporting strong household consumption, despite mounting household concerns about the economic situation in the future. However, February confidence data brought a solid fall in this sub-indicator to a level last seen in mid-2015. This suggests that household consumption might weaken in the forthcoming period due to a weaker willingness to spend and higher intention to save (see the chart).

Parts of Czech households' confidence

Business confidence also weaker

Business confidence fell due to weaker confidence in services and construction, while retail trade and industrial confidence improved. Although it remained at multi-year lows, expected production on a three-month horizon significantly improved in industry, which seems a positive development, though the question is how realistic this expectation might be following the Covid-19 outbreak.

Mixed message

February's data presents a relatively mixed message overall, in our view. The impact of the coronavirus seems to be muted so far but household consumption – which has been the most important growth driver in recent years – might be jeopardised as worries start to dent households’ financial situation outlook. Given the fact that the coronavirus will most likely remain the main story in forthcoming weeks, a quick upward move in household confidence is not very likely. However, a strong deterioration in household spending is not likely either as the labour market remains tight.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap