Czech confidence declined in November

It's not surprising that confidence fell further in November amid a second wave of the pandemic and subsequent economic restrictions. While business confidence remains above the spring level, households are afraid of unemployment more than they were in April

Households more worried about unemployment

Household confidence fell sharply in October due to new restrictions, while the November decline was just modest. Overall, however, confidence among households is only slightly above the level seen in April this year. Compared to October, households' outlook for future economic development or their own financial situation did not change much, but their willingness to save decreased and their fears of rising unemployment increased further. These are now higher than in April and at a similar level as during the peak of the global financial crisis.

Business confidence better than in April

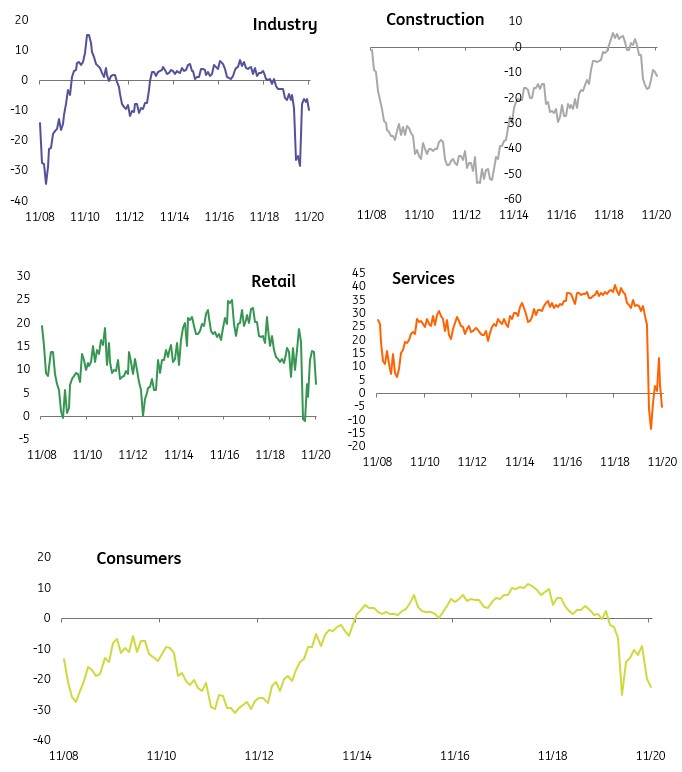

Business confidence fell in November in all monitored segments, but most significantly in services and retail trade, where economic restrictions were most pronounced due to the new Covid-19 wave. However, even here, confidence is still higher than during the first spring wave of the pandemic, probably because companies already know what to expect (see the chart). Confidence also declined slightly in industry, but remains significantly higher than in April, as industrial companies (especially car manufacturers) did not shut down during the second wave. At the same time, the decline in confidence among companies in industry was not driven by the current assessment of demand, where the situation even improved slightly in November, but by fears of future developments.

Confidence in the Czech economy

Weaker impact of the second wave due to industry

Overall, business confidence remains somewhere between June and July, and thus remains above April's level. This suggests that the impact of the second wave of the pandemic on the economy should be weaker, although it is very likely to see a quarterly decline in the last three months of the year. For the time being, households are also assessing their financial situation better than in April, but their fears of rising unemployment are growing, which may reduce their intention to spend.

New tax bill will support consumption

The question is how the planned reduction in income tax will impact consumption next year. It will certainly increase household spending, the only question is how efficiently given the costs involved (measured as a decline in government revenues), as some of this consumption will come from buying goods from abroad (which will not help the domestic economy) and some of it could be saved.

However, this will depend on the final parameters of the tax package, which will be amended in the Senate based on the latest information.

In its latest Inflation Report, the Czech National Bank presented an alternative scenario with massive fiscal easing (similar to the one approved), which leads to slightly higher GDP growth next year (+0.7ppt), higher inflation (+0.1ppt), and more rapid interest rates increase than in the baseline scenario (+2 hikes).

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap