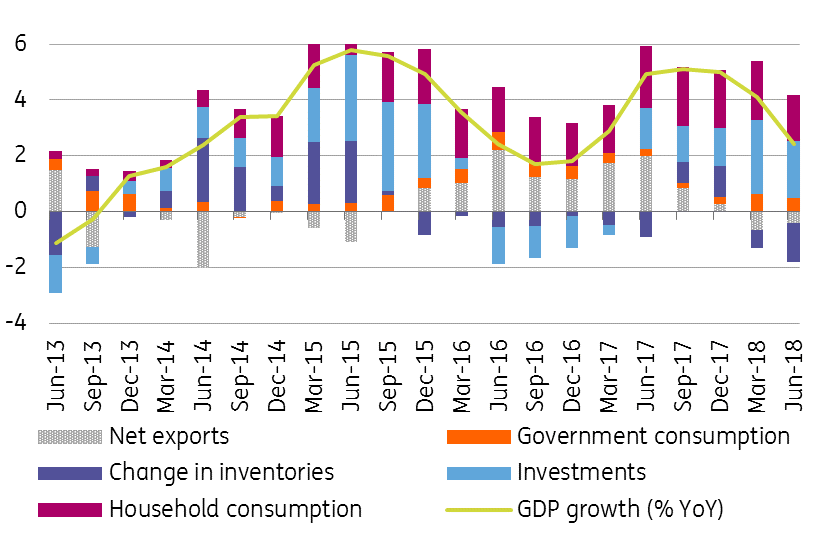

Czech 2Q GDP growth driven by domestic demand

The revised estimate of GDP confirmed 2.4% year-on-year growth in 2Q18. The detailed figures confirm that the Czech economy is driven mainly by investment activity and household consumption. Despite decelerating from 4.1 YoY in 1Q, economic activity accelerated slightly in quarterly terms

Growth on the back of investment activity and household consumption

Investment activity provided the strongest contribution to year-on-year growth (YoY). Although slightly weaker compared with 1Q18, it grew by 8% year-on-year and contributed two percentage points to YoY GDP growth. As in the previous quarter, investment growth was relatively broad based, with double digit growth for investment in dwellings, vehicles and machinery and investments in infrastructure. Household consumption remained favourable in 2Q and though YoY growth slowed slightly, it maintained a favourable rate of 3.5%, contributing 1.7ppt to GDP growth.

Negative surprise in inventories

However, inventories surprised on the downside and dragged down the year-on-year growth rate by -1.4ppt. The fall was not just because of a high base effect from a year ago, it also fell in quarterly terms (-1.3%). This might suggest that newly started investments were weaker in 2Q and as such did not flow into inventories, while a large portion of finalised investments were shifted from inventories to final investments.

Net exports negative, but less than thought

Net exports also contributed negatively to growth, which is not a surprise. Imports are growing due to stronger domestic demand and import-intensive investments while exports are slowing down due to slightly weaker foreign demand, the limited capacity of producers, a high base and stronger koruna. Net exports are thus contributing negatively to YoY growth, but not as much as expected (just -0.4ppt), which might ultimately be related to weaker new investments in 2Q, as previously mentioned.

Annual GDP growth structure (ppt)

Consumption remains strong, enabling the CNB to hike further

All in all, the detailed GDP structure confirmed that growth in the domestic economy was driven mainly by domestic demand, due to favourable household spending driven by accelerating wage growth. Even if the YoY dynamics of the domestic economy slowed down markedly from 4.1% in 1Q18 to just 2.4%, the base effect plays a role. The average QoQ growth rate of the last three years was 0.8% compared to 0.7% in 2Q18. This shows that the slowdown is not as acute as it might seem. Moreover, household spending remains strong, and an overheated labour market together with government measures will push up wages further. This development was expected in the latest CNB forecast, which sees two more rate hikes this year. Taking into account a relatively weak koruna, the chances for a September hike are increasing in our view.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap