Covid, chips shortages and government policies hit China’s economy

Covid has led to unexpectedly weak retail sales growth, while chip shortages continue to put pressure on automobile investment, production and sales. Government policies are adding even more stress to the economy. We expect a cut in the Reserve Requirement Ratio in October

Shocked by weak retail sales

The consensus forecast for retail sales was 7% year-on-year. It came in at 2.5% YoY. This shows how inbound tourism has been affected by even localised lockdowns after a small number of Covid cases were found. People are clearly worried that they could get trapped in tourist destinations if Covid cases emerge, and have therefore been less keen to travel across provinces over the summer holidays.

A rebound in retail sales growth is expected in September as Covid cases have been limited in Fujian.

But we are starting to worry that government policies are hurting the job market and as such, sentiment around spending could come under pressure. This should be reflected in moderate growth in retail sales from September to at least the end of 2021, unless some of those policies are unwound, which is very unlikely.

China retail sales weakened quickly

Automobiles still affected by chip shortages

Whether in terms of investment (-4.4% YoY year-to-date), production (-12.6% YoY) or sales (-7.4% YoY), automobiles contracted on a year-on-year basis. Chip shortages are the main reason behind this. And there is no indication as to how long this will last.

So far, the damage from chip shortages is most obvious in automobiles, but we expect it could also affect sales of smartphones. Though smartphones are not as durable as cars, they share some similarities. Consumers can defer upgrading their phones if new versions are similar to their existing phones, and they want to save rather than spend.

China investment by sectors

Disappointing infrastructure investment

Surprisingly, real estate investment grew around 10% YoY YTD. Some fourth tier cities have imposed home price floor controls, i.e. home prices could not fall below a certain level, helping to stabilise the housing market.

I expected infrastructure spending to speed up in August to support the economy from weakness caused by a policy clampdown. But that did not happen. Infrastructure investment grew only 2.9% YoY YTD. Job security is now the crucial factor in determining whether the middle classes can stay in the residential property market. If they are unemployed, they may not be able to repay mortgages and there could be fire sales.

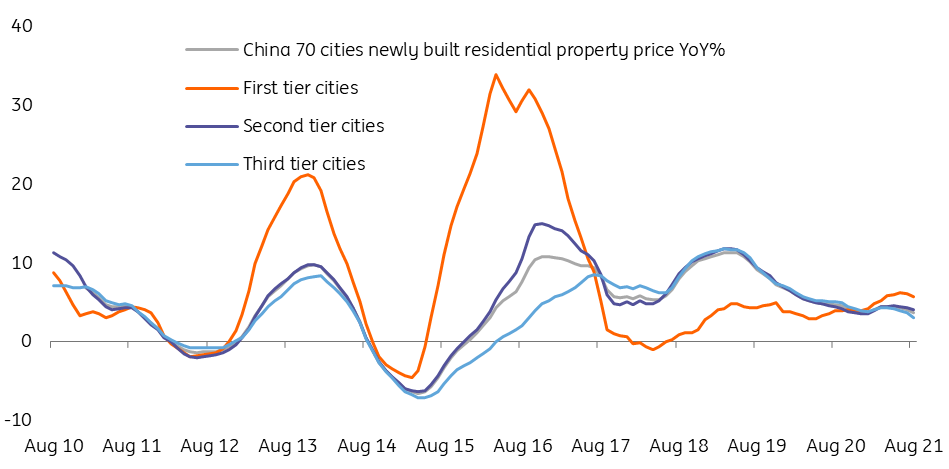

China home prices

Hope that policy has hit the pause button

We hope that the Chinese government will wait to see what the impact is from recent policies. There have been many policies coming out in a short time frame, some of which have hit the job market. Each policy may not create obvious damage to the economy, but added together, they could result in a sizeable hit.

RRR cut is expected

We forecast a broad based RRR cut of 0.5 percentage points in October. Today's weak data and the cumulative impact of policies mean the economy needs more liquidity to lessen the impact of rising credit premiums.

We are considering revising our GDP forecast lower. The current forecast is 8.9% for the whole of 2021. Aside from this set of weak data, exports are expected to be soft due to Covid in export markets and high freight costs.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap