Copper stocks jump, but keep calm and carry on

LME copper stocks have jumped 30% or 65kt in the last two days but fear not, such sharp inflows have been common since 2016 and bear little relation to market fundamentals

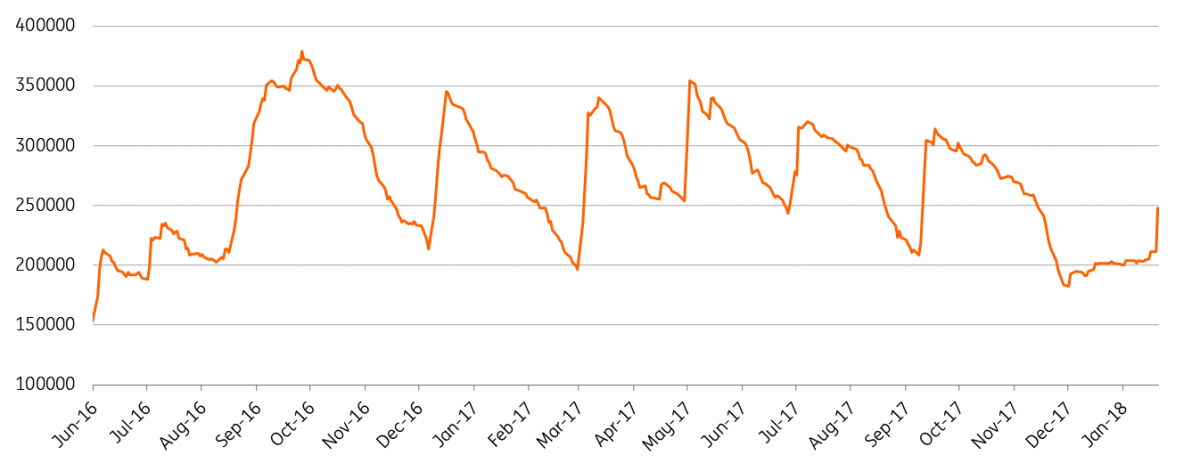

Volatilty is the norm for LME copper stocks

Stock deliveries trigger sell off

Copper prices fell 2% on the LME on Tuesday following the delivery of 34kt into LME sheds in Asia. Another 28.6kt has been delivered today with the market proving much more resistant and prices even rising as the US dollar weakens. Such sharp deliveries are, in effect, nothing new and do not reflect any changes to expected supply-demand balances. Rumours that this delivery was due were actually circling back in December.

In the absence of any backwardation at the front of the curve, a trader's decision to make delivery on the LME will rely on any incentives being paid by the warehouse owner. This can vary from upfront funds to rental shares for as long as the metal sits in storage. As with the previous seven such sharp deliveries, we would now expect this stock to be gradually drawn down through the coming months, probably sent en route to China given the proximity (most of the stock went to South Korea & Singapore). No surprises then if this is repeated by another sharp inflow in due course.

So why the sell-off? As we wrote this week, "the cracks are beginning to form'' in the metals rally and sentiment is growing that copper prices are uncomfortably high. Copper has been handed the Christmas gift of a weak USD and continually strong Chinese data, so it is telling that despite this blessing, prices have been flat year-to-date. Having seen the top, the stock deliveries gave bears the trigger, but signify little in themselves.

We forecast that copper prices will average $6,800 this year, which is more in line with the base levels needed to encourage mine investment.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap