China: Trade data shows little impact from tariffs, for now

Trade data has yet to reflect the full impact of tariffs, as export and import growth surprised on the upside. But smaller monthly bilateral trade between China and the US shows the tariffs have started to bite. To cushion the impact from tariffs, the Chinese government has put in place pre-emptive measures

No obvious impact

The impact of tariffs was not obvious last month. The US levied tariffs on $34 billion worth of Chinese imports on 6 July prompting China to retaliate with reciprocal measures. Still, some Chinese exporters were able to front-run deliveries in the first five days, so the impact wasn't felt over the entire month. In addition, this is the low season for exports; peak months are usually from September to November. So although we saw monthly declines in various items, we can't attribute this to the US move, particularly because not all of the items were even on the tariff list. As such, we think the export data has yet to reflect the full impact of the latest trade action.

Still, from another angle, we do see some impact. China's exports to the US fell 2.5% month-on-month and grew 19.0% year-on-year, and imports from the US fell 1.5% MoM with 16.0% YoY growth. This could still be a result of the low season, as China's exports to Europe also showed a monthly contraction of 2.3%.

However, the strong month-on-month export growth in toys and clothing could be a result of exporters "front-loading" deliveries to avoid possible tariffs in the coming months. If this is the case, then exports of toys and clothing in later months should be softer.

On the other hand, China's imports from Europe increased substantially by 51.7% MoM. Could China's importers switch their source of goods from the US to Europe? It is possible but we need more data to confirm this is a trend caused by tariffs.

The only thing we can conclude is that the tariff impact in July was not obvious but subtle monthly changes show that tariffs are changing the behaviour of some exporters and importers, and we expect this to become more visible in the coming months.

| 12.2% |

Exports in July (YoY)Tariff impact not fully reflected |

| Higher than expected | |

| 27.3% |

Imports in July (YoY)Mostly caused by high energy prices |

| Higher than expected | |

Impact on the economy could be offset by policy measures but SMEs at risk

The expected negative impact of tariffs on China's trade and manufacturing activities could hurt GDP growth in the third quarter. Another 25% tariff on $16 billion of goods from the US and from China should start 23 August.

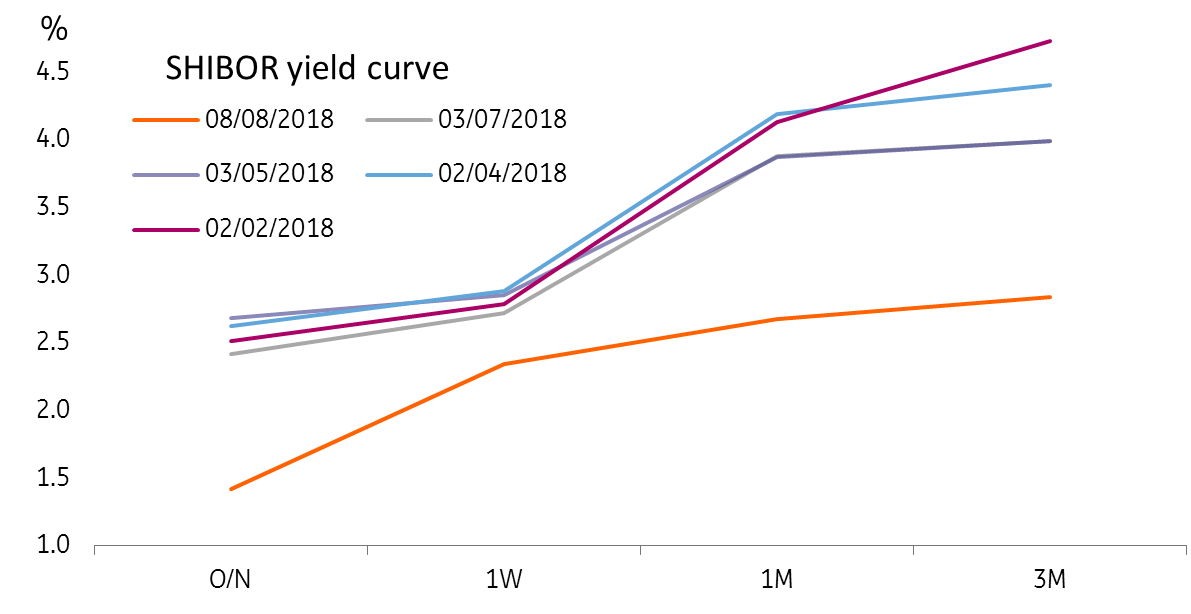

The Chinese government has realised the potential damage and has put in place fiscal stimulus and monetary easing, which include targeted RRR cuts and lowering interest rates from SHIBOR to deposit rates for government deposits at commercial banks. The central bank has also warned about the speed of the yuan's depreciation to avoid capital flight.

We believe that the government's pre-emptive policies will be able to offset some of the negative impact from tariffs.

The question is whether those stimulus and easing measures will help SME exporters, which could have borrowed from P2P lending platforms that have been recently torn down by the government, and now need to borrow from banks instead. This is important to keep SMEs alive. But banks should be careful to avoid high credit risks.

We expect the central bank to allow SMEs to get more liquidity from banks by relaxing macro-prudential assessment parameters and targeted RRR cuts so that the credit costs on SMEs can be reduced. On the fiscal side, we believe that the government could help SMEs with money collected from tariffs.

Allowing SMEs to fail would create unemployment, which could lead to social unrest- something the Chinese government will try hard to avoid.

SHIBOR falling - PBoC cutting interest rate

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap