China: rosy industrial profits can’t halt yuan weakening

Chinese industrial profits held up well in May. The most profitable is the automobile setor, turning from a loss to a gain in May year-to-date. Technology-related sectors did better, too, but trade and investment tensions cloud the prospects for these sectors

Profits of automobiles and technology sectors improved in May

Headline industrial profits rose 21.1% year-on-year and 16.5% YTD YoY in May. Profit growth is still on a rising trend in China. This confirms our view that China GDP should reach 6.7% YoY in 2Q18.

The automobile and computation, telecommunication and other electronic equipment sectors moved from losses in April to gains in May (from -0.6% YoY YTD to +0.5%, and from -5.3% YoY YTD to +4.3%, respectively).

Autos is the most profitable sector, contributing almost 10% of total headline industrial profits. The computation, telecommunication and other electronic equipment sector is the fifth most profitable in China, contributing around 6% of headline profits. The data implies that the economy was running at higher speed in May than in April.

| 16.5% |

Industrial profitsYoY YTD in May |

Trade and investment wars may hurt the technology sector in 2H18

We expect industrial profits to continue its growth trend in June as these are yet to be affected by escalating trade and investment wars between China and US.

But we worry that profit growth of these sectors will slow in 2H18, with the US administration trying to limit US investment and business opportunities for Chinese technology companies.

China shows muscle and allows faster yuan depreciation

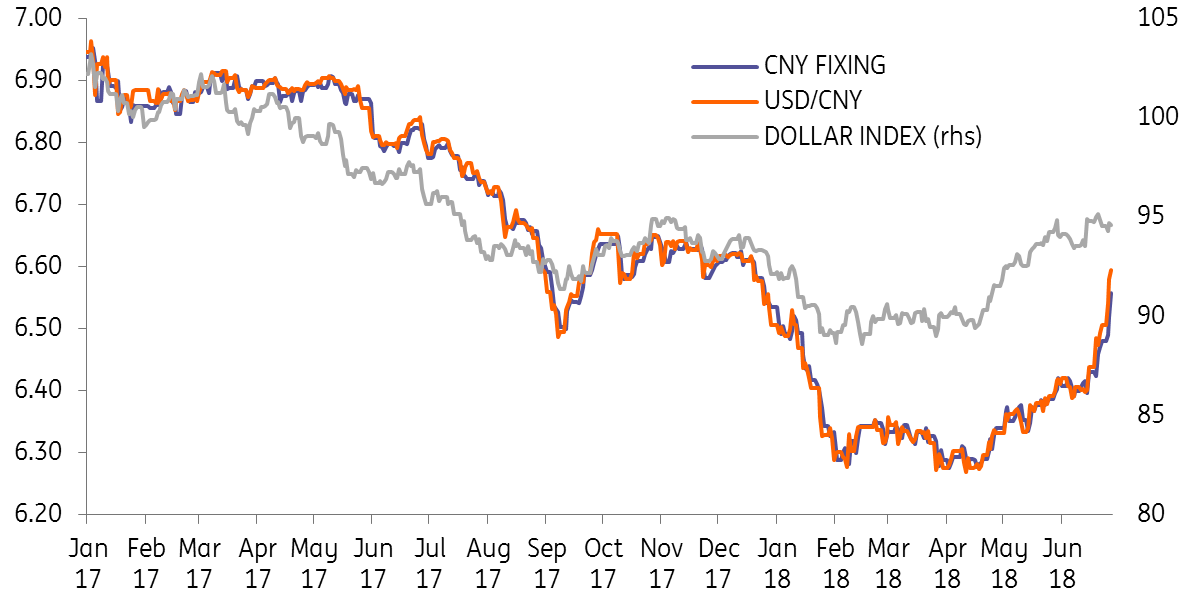

The good report card from industrial profits does not change the yuan depreciation path. The yuan is touching our year-end forecast of 6.60 against the dollar.

We believe that China is showing the US that it can allow the yuan to depreciate to cushion part of the negative impact on exporters. It is clear however that currency depreciation cannot offset all the tariff impacts.

It's a surprise to us that the yuan has weakened so quickly. Opening up the financial markets and green energy automobile market, plus additional A share inclusion in the MSCI, could bring capital inflows into China to offset capital outflows driven by the weak yuan. We expect that outflows will slow as yuan depreciation speeds up. These would reduce central bank concerns that foreign exchange reserves would deplete quickly and so give it room to allow further yuan weakening.

We will review our USD/CNY forecasts.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap

27 June 2018

Good MornING Asia - 28 June 2018 This bundle contains 1 Articles