China: Baby steps towards a trade truce

We've seen two positive developments in the ongoing trade conflict between the US and China. China says it will cut US automobile import tariffs and Huawei's CFO has been granted bail. But these are small steps. Bottom line, we think the USD/CNY should fall to 6.86-6.88

China is willing to cut US automobile import tariffs, but it's a baby step

There is a high chance that China is going to cut US automobile import tariffs from 40% to 15%, which will put them in line with other countries' automobile imports.

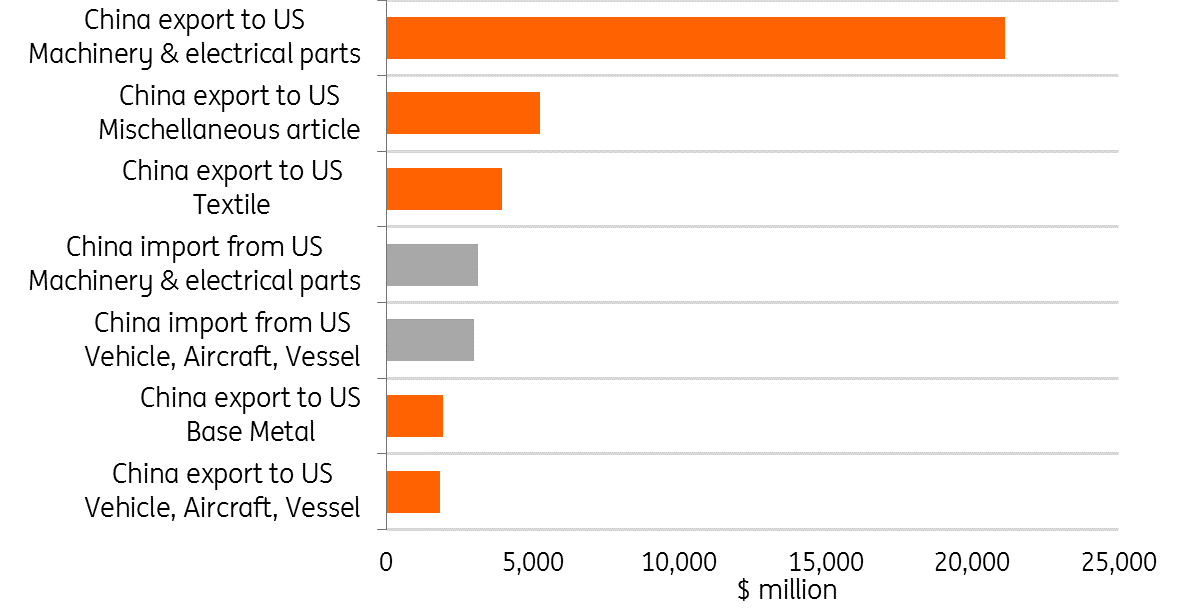

Though this will not close the trade gap between the two economies by a sizeable amount, it will be the first positive outcome from the 1 December dinner meeting between President Xi and President Trump. Of the $51 billion of vehicle imports into China last year, around $13.5 billion were imported from the US. This is equivalent to 4.86% of the bilateral trade gap based on China's trade data.

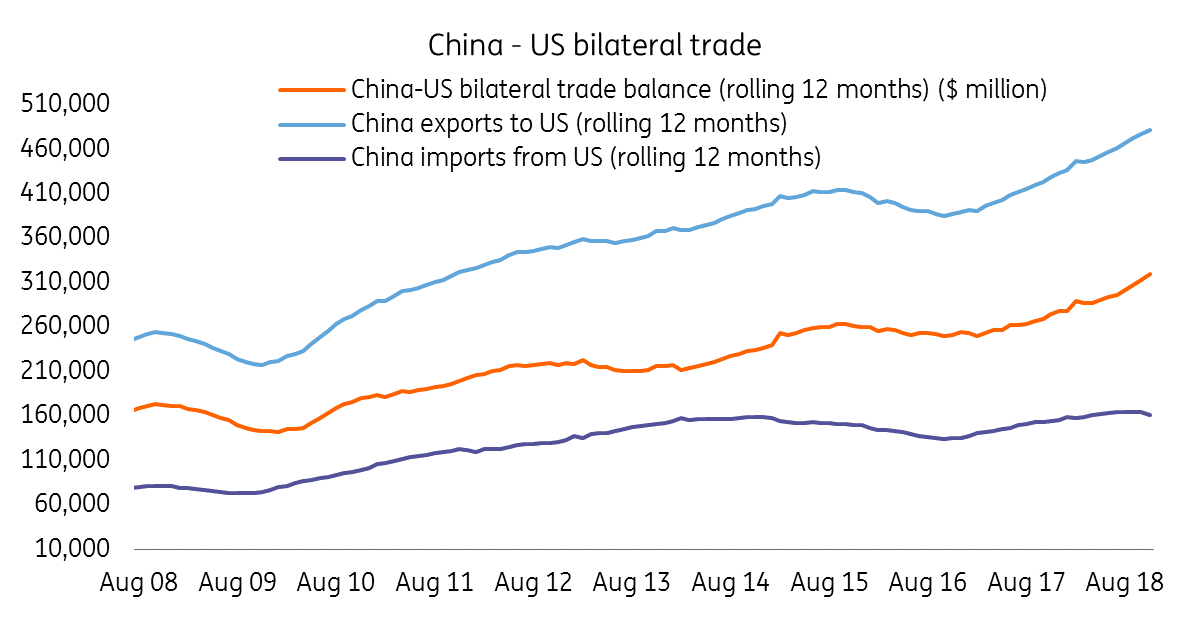

China US trade gap

Bail of Huawei's Meng makes further trade talk less complicated

Overnight, the Wall Street Journal reported that Huawei's CFO Meng Wanzhou was granted bail from the Canadian courts. This will certainly make the trade talks during the 90-day truce less complicated. But unless the US withdraws the Huawei case altogether, it is unlikely that either side will make significant progress towards tariff reduction during this period.

China-US trade sorted by commodity

The truce will not address China's development of advanced technology

From the Huawei case, it is increasingly obvious that the China-US trade war is about the exchange of technology, and the development of advanced technologies by Chinese companies.

The truce will not address these issues. And therefore tensions between China and the US will continue, even if it may not be in the arena of trade.

On this front, newswires report that the US is considering issuing a travel warning to US citizens and business executives travelling to China, and China has detained an ex-diplomat, most likely as retaliation for Canada's arrest of Meng.

Whether China can keep its big technology companies alive in the face of increasing difficulties exporting their products is a crucial question. The upcoming Central Economic Work Conference, possibly held from 14 to 17 December, may provide a guide.

USD/CNY should trade between 6.86 and 6.88 with the positive news overnight. But as we expect the actual cancellation of trade tariffs to be slow, we don't expect the yuan to appreciate too much before the end of 2018. Our year-end forecast of USD/CNY at 7.0 is now at risk, we are looking at to revise next year's forecast, which is now at 7.3.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap