China: PMI signals growth moderated before holidays

Both manufacturing and services strength slowed in January from the previous month. This signals that the Chinese New Year effect on activity is negative as people take long holidays. But we expect consumption in cities to surpass previous years' Chinese New Year holiday spending as more people will remain close to their work location.

Strong growth continues but affected by the Chinese New Year

Both manufacturing and service PMI stayed above 50, at 51.3 and 52.4. but fell slightly from the previous month, which were 51.9 and 55.7, respectively.

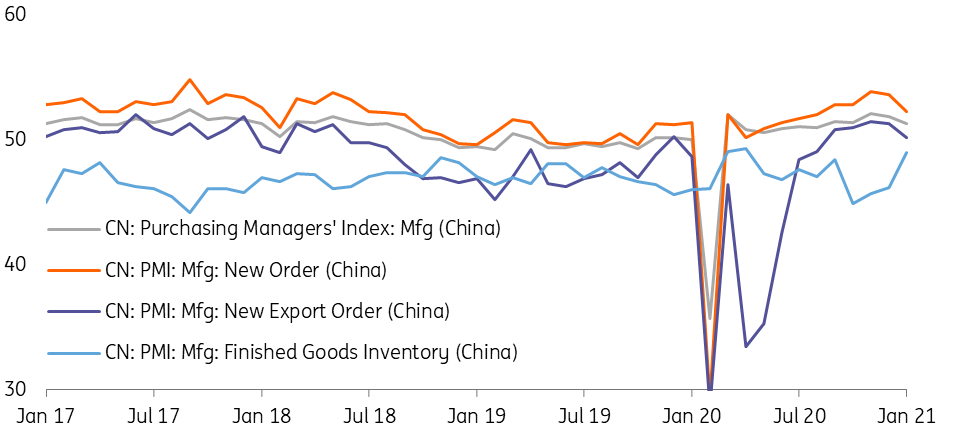

In manufacturing, domestic export orders and new export orders were still above 50. These forward looking indicators show that China's production for both domestic market and external market should keep rising in the coming months.

In services, the situation is more diverse. Construction activity PMI at 60.0 in January, fell only slightly from 60.7. But travel, hospitality, catering and entertainment related were below 50.0. The domestic order subindex fell into contraction at 48.7 from 51.9 from a month ago. These look worring but in fact may not be the case.

China manufacturing PMI

A word on Chinese New Year spending

We expect that this Chinese New Year would bring more service activities in February in urban locations due to stay at work location Chinese New Year holiday to prevent Covid infection.

This change in people flow would make 2021's Chinese New Year spending very different from the past. There should be a higher level of spending as urban's living standard is higher than rural areas. This could also be the a unique Chinese New Year that some staff will be working during this long holiday, e.g. the delivery industry to serve online shopping, more local leisure tours in the urban areas.

So the drop in services PMI in catering and other spending could be temporary.

China non-manufacturing PMI

A word on construction PMI subindex

On construction activities, we have noted that China has started deleveraging reform, and the real estate sector is under the spotlight. But we expect that construction activities will continue to be stable in 2021 from 2020 as real estate property developers need to flats to be sold to get cash back for repayment of debts. If construction slows down, the repayment of debts will be in question, the market may react before any delay of payments, and would therefore create a self-fulfing debt-missing expecataion.

As such, we don't expect overly tight policies on real estate developers.

China construction PMI (under non-manufacturing PMI)

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap

31 January 2021

Good MornING Asia - 1 February 2021 This bundle contains 3 Articles