What we expect from China’s first-quarter GDP report

With the Services PMI beating estimates, we're expecting strong retail activity data for March. But weaker export demand should drag on GDP. The government could provide stimulus to the economy after the release of the first quarter GDP data on 18 April

Services is becoming a growth engine for the Chinese economy

The Caixin service PMI was 57.8 for March, up from 55.0 the previous month. This is the highest level in more than two years, since November 2020. The rise can be attributed to the subindices of employment, which is also at its highest level since December 2020, and robust new orders that led to tightness in capacity.

With the faster recovery, there is rising price pressure seen in input prices but that has not been completely passed through to the selling price due to intensive competition.

Retail sales in March should grow faster

From what we have seen in the official non-manufacturing PMI and Caixin services PMI, retail sales in March should grow faster on a monthly basis. We should see a broad-based recovery of retail sales, except for automobiles, which should suffer from the end of subsidies for electric vehicles.

That should lead to around 5% year-on-year growth of retail sales in March after 3.5%YoY year-to-date growth in February. If we are correct on this forecast, then retail sales in the first quarter should grow 4%YoY.

While this is still lagging behind the 5% GDP growth target set by the government in the Two Sessions meeting in March, we need to remind ourselves that China is at the beginning stage of its recovery. The speed of recovery of retail sales, representing the growth of the domestic market, should pick up faster in the second quarter.

GDP lagging behind

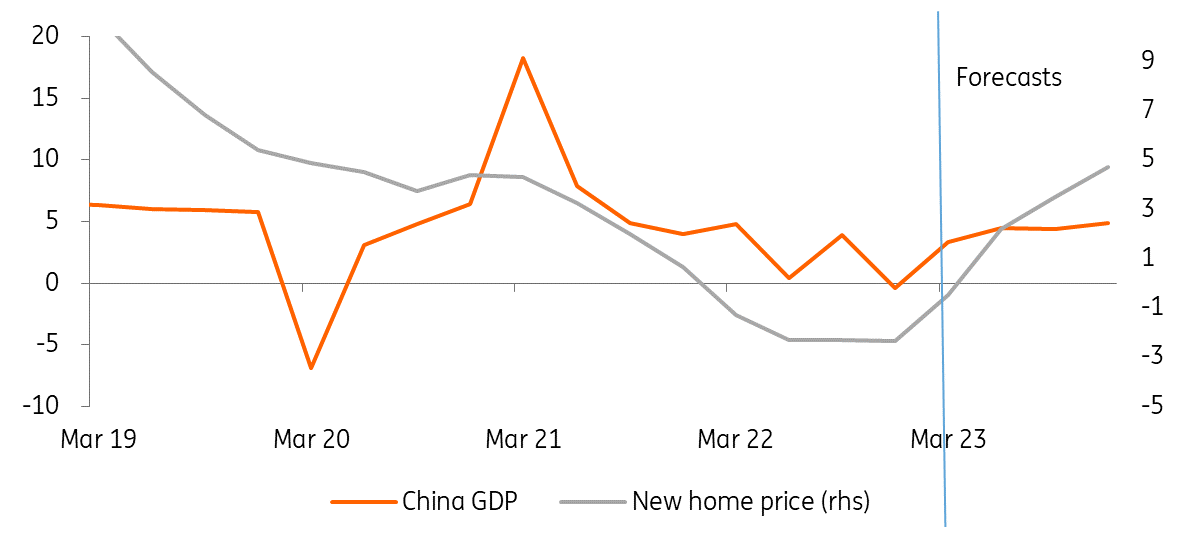

GDP for the first quarter should lag behind the 5% growth target for the whole of 2023. We expect GDP to only grow 3.8%YoY in the first quarter of this year.

This is because of the slowing growth of external demand that should hurt exports and manufacturing activities. The removal of subsidies for electric vehicles has also led to the slowing production of automobiles compared to the same period last year.

China GDP and new home price forecast

Stimulus is likely to follow the GDP report

We expect stimulus to follow quickly after the release of the GDP report for the first quarter.

1. Infrastructure

To keep the 5% growth target for 2023, the government needs to push forward infrastructure investments, most of which should be building metro lines and increasing the number of 5G towers as these are already in the plan for this year.

2. Consumption

An extra stimulus could be resuming subsidies for electric vehicles after the sharp fall in automobile sales when the subsidies ended at the end of 2022. If the government believes that it has spare fiscal strength, it could also provide subsidies for consumer electronic goods. This could support the sales of domestic semiconductor companies.

The improving service sector should provide a stable wage for the labour force. The stimulus should further stabilise labour demand in the manufacturing sector. These are the foundation of the increasing appetite for buying homes again in the economy. As such, we expect a moderate increase in new home prices in 2023, which should induce retail sales further via the wealth effect.

We, therefore, expect GDP to grow faster at 6.0%YoY in the second quarter. We keep the full-year GDP forecast at 5% as external demand should be a concern for the year.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap