China: Manufacturing PMI contracts in April

After avoiding monthly contractions since the start of 2023, China's manufacturing PMI showed activity contracted again in April. This is a warning signal to the Chinese economy. The slower expansion in non-manufacturing activity is not a concern just yet as it is usually quieter anyway for retailers in April before the long holidays in May

| 49.2 |

Manufacturing PMIfrom 51.9 |

| Worse than expected | |

Manufacturing contracted for the first time this year

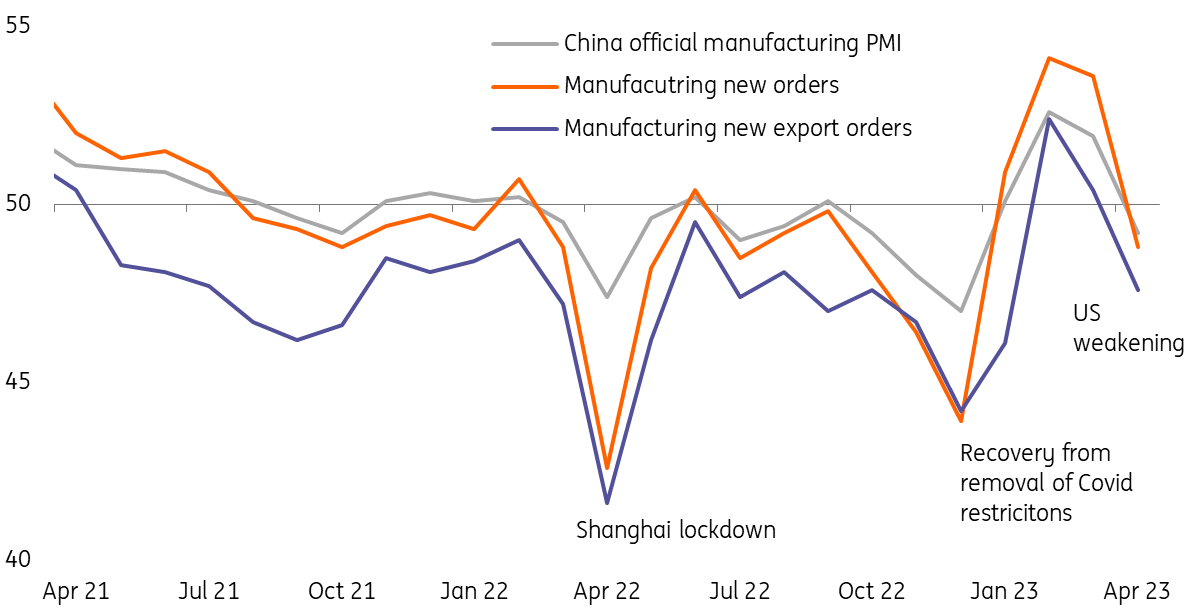

China's manufacturing PMI showed a surprise contraction in April, falling to 49.2 after three straight months of growth since the start of 2023. Most sub-indicators show that this might not be a short-term aberration. For example, export orders fell to 47.6 in April from 50.4 in March, while imports fell to 48.9 from 50.9. In addition, output prices fell deeper to 44.9 from 48.6. This could be due to new orders (which could be for the domestic market), also falling into contraction (down to 48.8 from 53.6).

From these numbers, it appears that the weakening export market has started to affect the domestic economy. The feed-through channel is through lower wages and employment in export-related factories, pushing wages lower in the manufacturing sector. The employment sub-index has shown a contraction in hiring for two months already.

This weakness is easily passed through to the service sector. When employees in the manufacturing sector face lower wages, they may find a job in the service sector. This reduces wages in the overall job market, especially for low-skilled workers.

Weakening external market has started to put pressure on the domestic market

Slower growth in the service sector

The official PMI shows that non-manufacturing activity slowed to 56.4 in April from 58.2. This slowdown is usual for April as consumers defer consumption to the long holiday period in May.

But as we mentioned earlier, the contraction in manufacturing activity could put pressure on wages in both the manufacturing and service sectors. This would later turn into slower retail sales growth.

Stimulus could be coming

We expect the Chinese government will release stimulus measures to support both the manufacturing and service sectors. One measure could be resuming subsidies for electric vehicles – this would provide support for car sales and manufacturing. The other stimulus could be pushing infrastructure investment faster, which would be supportive of manufacturing and construction activity.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap