China: local government financial vehicle resurgence

China's local governments again use their financial vehicles to borrow in the corporate bond market, meanwhile, shadow banking credit fell less than expected. Both signal the central bank is keeping credit flowing to fight the trade war.

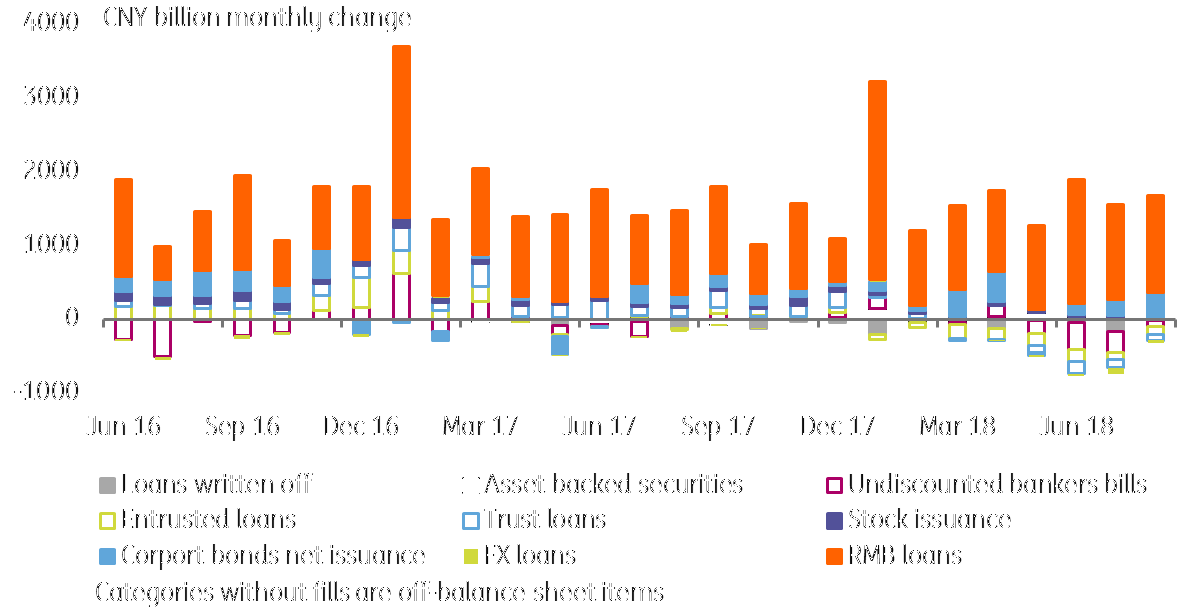

China's credit expansion though still rely most on yuan loans, but other non-desirable components also create credits

All credits in the system grew CNY1520 billion in August, of which, yuan loans were CNY1310 billion - changes of +46%MoM and -11.7% MoM respectively. That means other non-loan growth channels have created credits.

The chart shows that another big credit expansion item is "corporate bond net issuance", which rose CNY337.6 on the month (51% MoM). However, these "corporate credits" may not be genuinely corporate. We believe that as local governments have been put on a fiscal stimulus plan, and to avoid massive increases in local government debt, the old route of issuance of local government financial vehicle bonds has re-emerged. These bonds usually do not have local government guarantees. And we have read accounts of defaults on interest and/or principal repayments of such paper.

Risks are building up, but are unlikely to pose a serious threat. When the credit cost of these papers increases, it will become increasingly difficult for local governments to issue such paper. And they will eventually have to turn to other sources to finance infrastructure projects.

China's credit expansion composition

Asset management products provide some liquidity to banks so deposits still not growing fast

M2 rose 8.2%YoY, which was the same as our forecast. We do not expect a large jump in deposit growth even though structured deposits are growing. Some asset management products are being revived as regulations on them are being temporarily relaxed.

Trade war is the key to credit growth

If the trade war escalates, credit growth will speed up rapidly. That will solve a temporary problem for SMEs or other export-related corporates that have not received a lifeline.

But the side effect will show in a few years after the trade war ends when interest costs will have risen.

We do not expect the PBoC to follow the Fed rate hike in September

Due to the need to expand credit to offset trade war damage, we do not expect the Chinese central bank (PBoC) to follow an expected Fed hike in September. On the contrary, we expect the PBoC may start to cut interest rates in due course if the trade war escalates.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap