Chinese aluminium disruptions

Recent news on aluminium supply-side disruptions from China has pushed up the three-month prices to their highest on the Shanghai Futures Exchange since last September

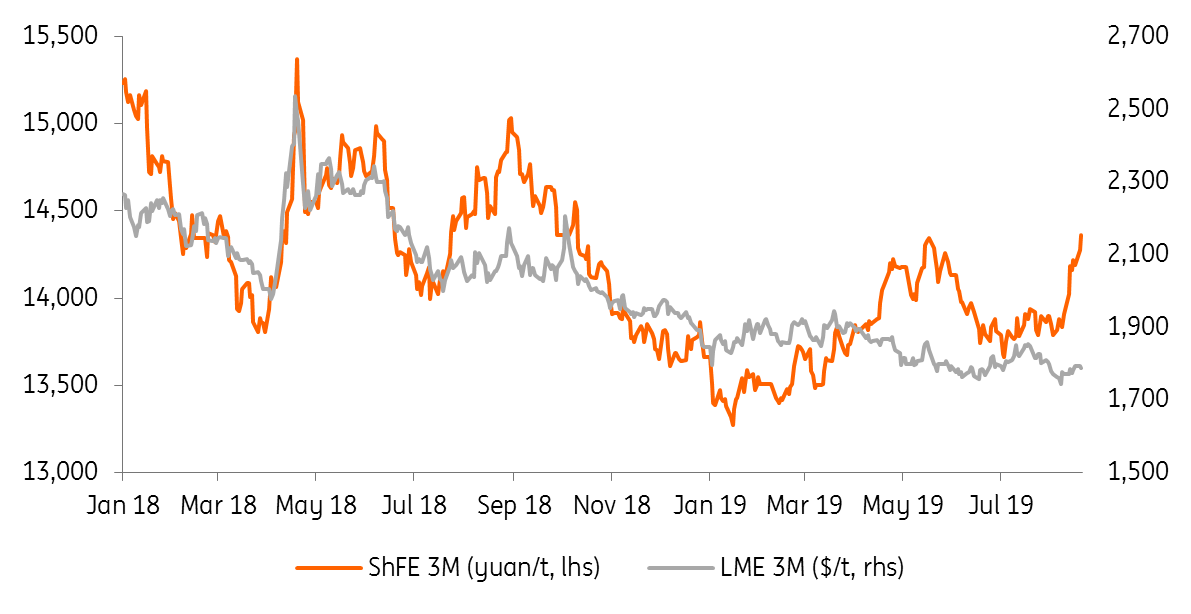

Aluminium prices on LME and ShFE

Aluminium markets are demonstrating divergent strength between the Shanghai Futures Exchange and the London Metal Exchange.

ShFE aluminium prices have been trading at CNY14,360/t - a year-to-date high today after reports that Xinfa Group closed a 500ktpa aluminium smelting plant in Xinjiang province for at least three months due to an incident on 18 August. This latest development follows market concerns over the potential impact that floods in the Chinese province of Shandong could have on aluminium output. LME prices have yet to respond as strongly as the ShFE market.

On Tuesday, rumours suggested that another Chinese smelter may reveal plans to suspend around 600ktpa capacity until the end of this year. If this is confirmed, this could lead to a change in the Chinese market balance, shifting from a surplus to a deficit market this year, which will be a bullish note to ShFE prices. This may also lead to a slowing in China’s pace of semis exports, which have helped to fill the ex-China primary deficit.

At the moment, the ex-China primary aluminium market still remains in deficit. If the Chinese market were to switch to a deficit or even balance, the tightness is likely to be felt in the ex-China market through a slowdown in semis exports, which may provide some support to LME prices.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

AluminiumDownload

Download snap