China shows a gradual recovery

The market focus will be on retail sales and real estate in this set of activity data. We also focus on infrastructure investment. This is a “supplementary” growth factor in case consumption is not growing adequately. But it is at the same time limited by high levels of local government debt

Retail sales

Retail sales grew 3.5%YoY in the first two months of the year after contracting by 1.8%YoY in December. This growth rate looks quite moderate, though when we exclude car sales, retail sales grew 5.0%YoY YTD (car sales fell 9.4%YoY YTD). The fall in car sales was mainly a result of the discontinuation of subsidies on electric vehicles at the start of this year.

Removal of Covid restrictions boosted catering, which increased by 10.2%YoY YTD. Our preferred indicator of an average consumer's consumption appetite is clothing, which rose by 5.4%YoY. This is an encouraging sign of returning consumption sentiment.

Weaker exports continue impacting industrial production

Industrial production increased 2.4%YoY after 1.3%YoY growth in December, which was an improvement, but still a little softer than expected. The National Statistics Bureau added that month-on-month growth in February was just 0.12%, which is very weak, reflecting weakening exports. The biggest export item, electronic parts, including semiconductors, fell 17%YoY YTD. Microcomputing products fell 21.9%YoY YTD and smartphones fell 14.1%YoY YTD.

But if we look at industrial production for domestic use then it is not too bad. For example, electronic equipment production rose 13.9%YoY YTD in February, indicating the need for equipment updates after Covid. Real-estate-related materials such as cement continued to fall.

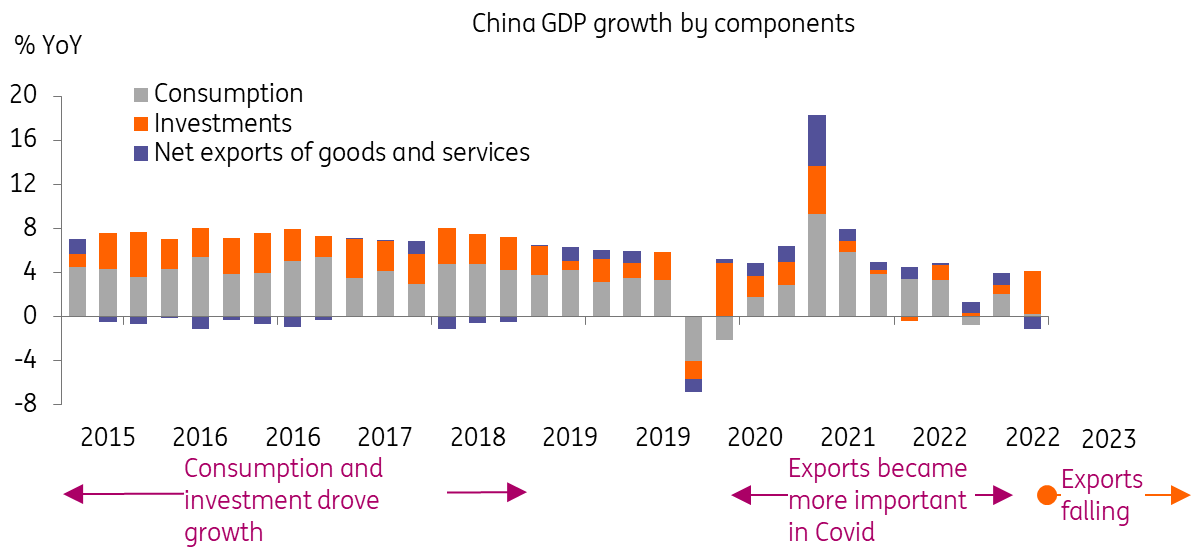

Exports dragging on GDP growth

Fixed asset investment growth is steady

Fixed asset investment grew 5.5%YoY YTD in February, after 5.1% growth in December. We focus on infrastructure investment, which we view as a "supplementary" growth driver in case consumption is not growing as well as needed during 2023.

Infrastructure investment grew 9%YoY, mainly coming from public utilities, which grew 11.2%. We believe that this is the post-Covid restructuring of local facilities. Looking at railway investment, which includes metro investment, this grew 17.8%YoY. It looks like this part of infrastructure investments is picking up momentum and so the supplementary growth engine is providing support. But rising local government debt could slow down infrastructure investment at any time. Local governments could be forced to cherry-pick only essential infrastructure projects to avoid increasing debt too quickly.

Real estate investment fell more slowly at -5.7%YoY YTD, an improvement from -10% in December. That is in line with our expectations, with small numbers of home buyers taking advantage of low home prices and re-entering the market. This creates some positive sentiment in the housing market, but a full return of sentiment needs all uncompleted homes to be finished to a good standard, which is still a concern. Consequently, we only expect positive growth of real estate investment to return in 2024.

China land sales still in contraction

Our forecast of GDP growth at 5% remains unchanged

We retain our GDP forecast for China at 5% for 2023. The main reason is that although consumption should rise moderately, there are headwinds for China, including exports and local government debt that could derail infrastructure investment as well as the slow recovery of the real estate sector.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap