Chile’s IMF deal helps stabilise the peso

Chile’s agreement with the IMF for an $18.5bn Flexible Credit Line should offer some much-needed comfort to investors concerned about significant FX intervention and the fall in international reserves this year. A widening current account deficit and domestic political uncertainty present risks despite the nation’s overall strong credit profile

Chile turns to the IMF

Chile has reached an agreement with the International Monetary Fund for a two-year Flexible Credit Line (FCL) arrangement, worth $18.5bn. The FCL differs from normal IMF programmes in that once agreed, there are no conditions for use and generally, they are seen as “precautionary” measures. Additionally, they are reserved for countries described by the IMF as having “very strong policy frameworks and track records in economic performance.” Chile, Colombia, Mexico, Peru and Poland have had FCL arrangements since their inception in 2009, while only Colombia has actually drawn on these resources.

The move looks significant for Chile, given the volatility seen in the peso this year and July’s announcement of a $25bn intervention programme by the central bank. International reserves at the central bank have fallen to $44.4bn from a peak of $55bn in October 2021, so the size of the FCL should provide a welcome but necessary extra buffer and offer some comfort to foreign investors who may have been concerned about the scale of FX interventions planned. The central bank only intends to draw on the FCL in an emergency, but if tapped it would augment the nation’s existing FX reserves.

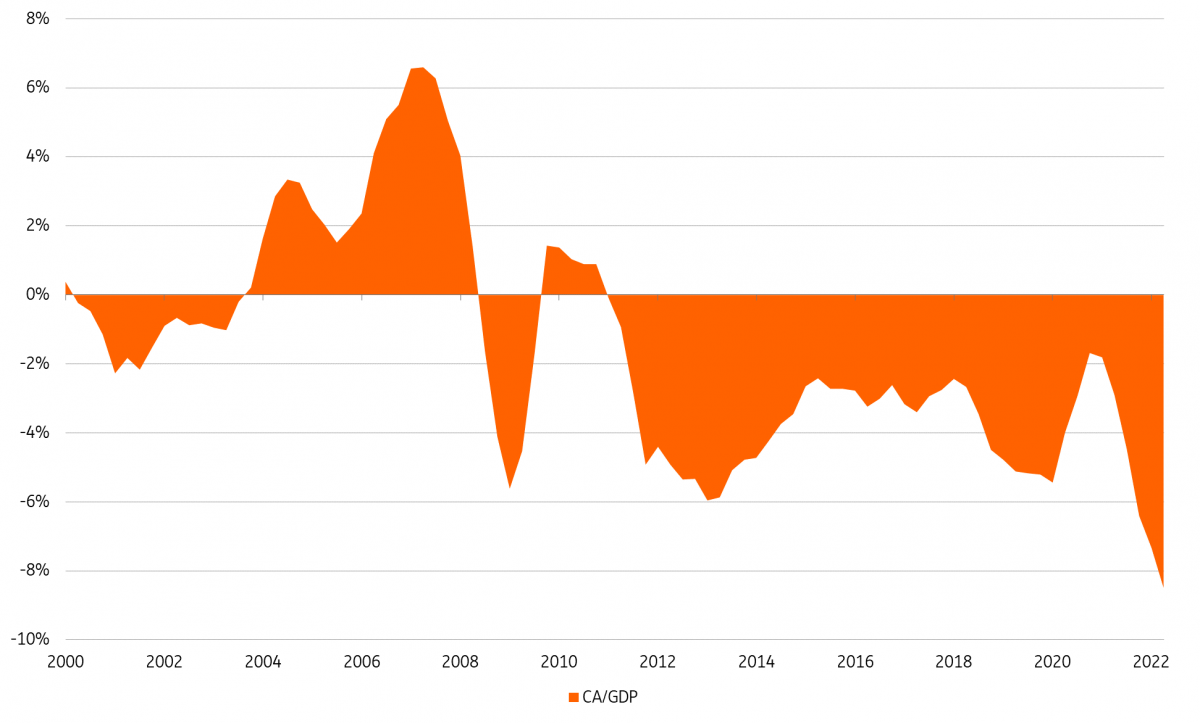

Chile has been struggling this year with a widening current account deficit of over 8% of GDP on a rolling annual basis as of the second quarter of this year, driven by weakening terms of trade. Copper prices, a key export, have come off the boil after rallying through to April while surging energy prices have driven imports higher. Against this backdrop, the nation remains one of the stronger hard currency sovereign credits in the EM space, with A1/A/A- ratings, but has performed weaker than its rating peers this year, with dollar bond spreads around 50bp wider on average YTD. Overall this latest agreement with the IMF signals an acceptance that the external backdrop is difficult for Chile, but should be seen as a marginal positive.

Chile's current account deficit at 8% of GDP is severe

Peso rallies but remains vulnerable

As we noted in the August edition of FX talking, we had felt that Chile committing nearly half of its FX reserves to a peso support programme was a dangerous move. Looking back on this, perhaps local officials at the time of the intervention announcement (late July) had some confidence that IMF support would be forthcoming.

The news of IMF support has been welcomed by the peso - but we would be surprised if it drives the currency substantially stronger. As we've noted, Chile's staggering current account deficit of 8% of GDP leaves the peso heavily reliant on foreign capital inflows. Chile's well-respected central bank and 10%+ implied yield through the 3-month non-deliverable forwards are peso supportive. Yet the very strong dollar story (something we expect to continue for most of the second half of the year), and the uncertain environment for industrial metals given the Chinese slowdown, suggest Chile's peso is not out of the woods yet. The most immediate event risk is probably a referendum on Chile's new constitution wich takes place on Sunday.

We continue to favour USD/CLP trading back above 900 for the remainder of the year.

Pressure on Chile's peso has depleted FX reserves - prompting IMF support

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap