Canadian inflation back to target as energy and domestic price pressures build

Canadian inflation is back at target, and given the better news on wage growth and economic activity of late, we think the Bank of Canada is likely to keep rates on hold for the time being

Having been down at 1.4% back in January, headline inflation in Canada ticked back up to 2% in April and we think there are two main reasons why it will stay at-or-above target over coming months.

1. Energy prices continue to rebound

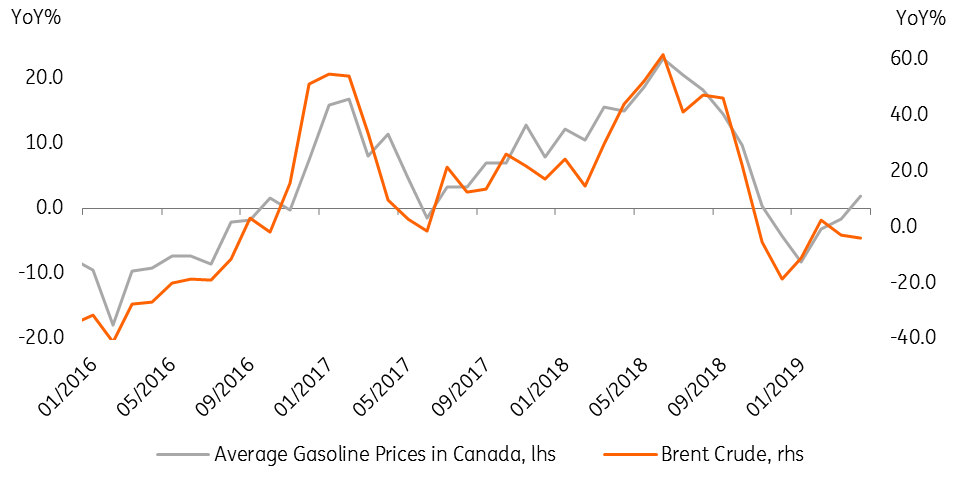

The latest rise in headline CPI was partly down to a rise in gasoline prices, which are now rising by 1.8% in year-on-year terms. This partially reflects the new carbon tax that has recently taken effect in some areas, but equally indicates that the lagged effect of the late-2018 oil price decline is gradually fading. Our commodities team have global oil prices edging slightly higher throughout this year and next, which further reinforces a near/on-target headline figure.

Gasoline prices continue to post a healthy recovery

2. Domestic price pressures could begin to intensify

Away from oil, the rise in inflation does look reasonably broad-based - seven out of the eight major categories increased year-on-year. Given the recent strength in the jobs market, we think that domestic cost pressures have the potential to gradually build. Wage growth is performing better, and this should begin to feed into household spending sooner rather than later.

We also agree with the Bank of Canada's (BoC) analysis that the drag from the housing market should begin to dissipate as the economy completes its adjustment to a different type of housing demand and higher interest rates. The 2019 Federal budget should also help first-time homebuyers by helping to absorb part of the initial cost of getting on the ladder.

Despite the potential for some better news on inflation over the coming months, we don’t expect to see the BoC budging from its current stance. That said, the gradual recovery in growth and inflation indicates that a rate cut is also unlikely this year.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap