Canada: Weaker jobs highlight rate cut risk

Canada lost 1,800 jobs in October with private sector employment falling for the third month out of the past four. Wages are holding up, but with more signs of economic weakness the odds of a 4 December rate cut are rising

Jobs weak, but wages remain strong

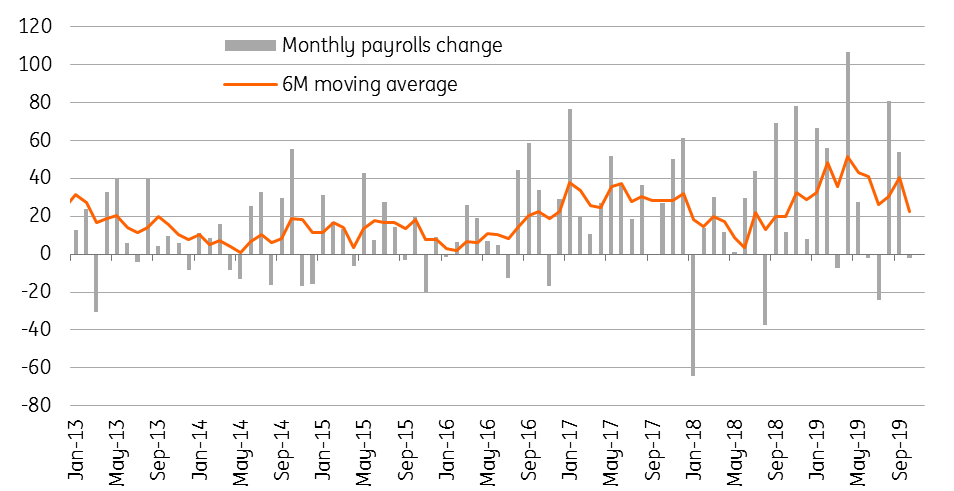

The Canadian jobs report for October is weaker than hoped. Having posted gains of 135,000 in the previous two months, employment fell by 1,800 versus expectations of a 15,000 increase. Worryingly, private sector employment has fallen for the third month out of the past four and for the fourth month out of the past six. This suggests that while unemployment remains low (5.5%) and wage growth is robust (4.4%YoY), the labour market may be peaking.

There was particular weakness in manufacturing (-23.1k) and construction (-21.3k) with transportation also seeing a decline in jobs. Public sector jobs rose 28,700 after a 32,600 increase in September, but we have to consider that some of these jobs were related to temporary hiring because of the federal election. As such, there is a strong chance they will unwind. Nonetheless, decent wage growth should keep confidence supported and the consumer is likely to remain the key bright spot in the economy.

Canada jobs growth (000s)

Data worries mount

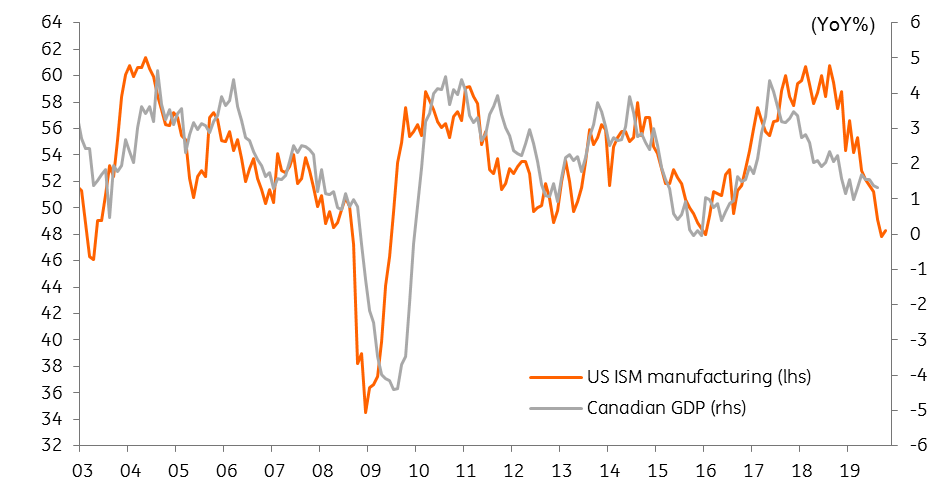

Outside of the consumer sector, recent data has highlighted a weakening trade balance and slower business investment growth, which is unsurprising given Canada’s relatively high exposure to commodities and external trade. This has been compounded by the strength of Canada’s dollar. Moreover, the IVEY manufacturing PMI has been in sub-50 contraction territory for the past two months, underlining the downside growth risks for 2H19. Key US indicators, such as the ISM, also highlight the risks for activity.

US ISM highlights downside risks for Canada

Gearing up for a BoC rate cut

Recent comments from the Bank of Canada suggest a reluctance to cut interest rates, but an acknowledgement they may have to. Governor Stephen Poloz said after last week’s decision that “it’s obvious that none of us has much room to manoeuvre, and some central banks have literally none left. This is when fiscal policy is most powerful and monetary policy is the least powerful”. This will put the pressure on the Liberal minority government to offer some stimulus, but that won’t come quickly and we suspect that the data will force the BoC’s hand.

Ahead of the 4 December policy decision, the BoC said the 29 November GDP report will be the “determinant”. The BoC has already laid the groundwork given its discussion of an “insurance cut”. We think it will happen, especially when you consider Canada has the highest policy rate among major economies, which is adding to upside pressure on the Canadian dollar and eroding international competitiveness.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap