Canada jobs: temporary respite

Canada created more jobs than expected in December, but this can’t hide the clear deceleration through the second half of 2019. With the activity story remaining uncertain we look for a further cooling of jobs in 2020

After a fairly torrid run, the Canadian jobs market ended the year on a positive note. Employment rose 35,200 in December, better than the 25,000 predicted by the market, while the unemployment rate dipped back down to 5.6% from 5.9%. This is a positive outcome given the second half of 2019 was in general pretty poor. Private payrolls had contracted in four of the previous five months so the creation of 56,900 private sector jobs in December is a relief.

Canadian monthly payrolls growth

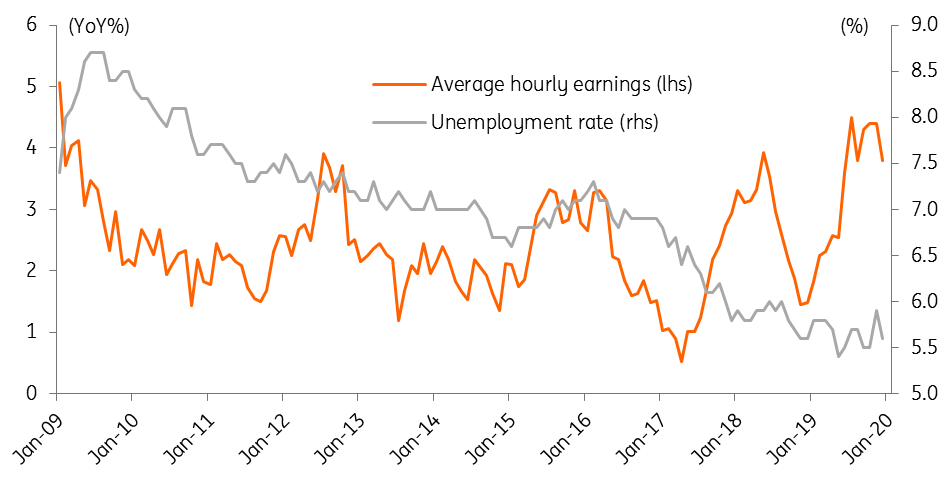

Although wage growth slowed, it remains very healthy and far stronger than pretty much all other major markets at 3.8% year on year. As such we should be seeing some pretty decent consumer spending numbers. Unfortunately we aren’t. Retail sales have been weak and GDP actually contracted in October while manufacturing and even the housing market are showing signs of moderation.

Canada unemployment & wage growth

Given this backdrop we expect payrolls growth to continue its softening trend and with unemployment closer to 6% rather than the 3%-4% handle comparable economies have, we believe that wage growth will slow further. This doesn’t alter the outlook for stable policy at the 22 January Bank of Canada policy meeting, but it leaves the possibility of action open for subsequent meetings.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap