Briefing Romania

Liquidity conditions deteriorating

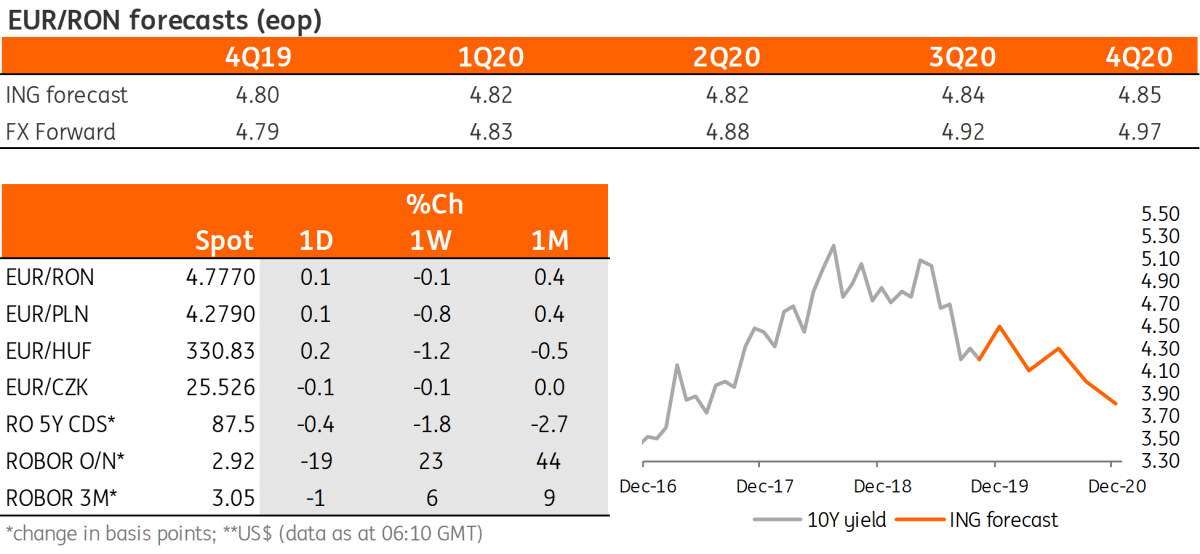

EUR/RON

The Romanian leu had a quiet Friday session, floating narrowly against the euro in the upper part of the 4.7700-4.7800 range. With carry still elevated, we expect the 4.7800 level to hold and look for the same 4.7700-4.7800 range today.

Government bonds

Despite some headwinds coming from core markets, Romanian government bond yields remained broadly stable. Today’s re-tap of Feb-2029 for RON500 million could see better demand than last month when all bids were rejected by the Ministry of Finance. But we certainly won't see better bids as the curve is now almost 20 basis points higher than at that time. We expect an average allocation around 4.65%.

Money market

On Friday, the central bank’s monthly bulletin confirmed the deterioration of liquidity conditions in the money market. The surplus liquidity for November decreased to around RON3.4 billion, from RON5.1 billion in the previous month. Worth mentioning that this figure does not capture most of the FX transactions from 28 and 29 November (as the spot date fell in December), when we had a significant increase in turnover fuelled by central bank intervention.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap