Briefing Romania

Primary market auction to test new low

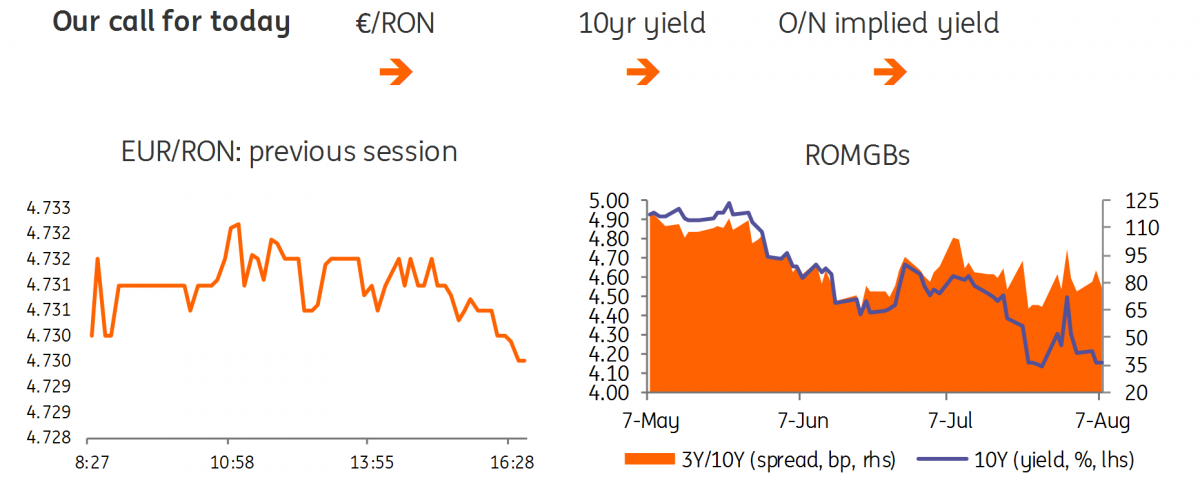

EUR/RON

The EUR/RON closed the day little changed just below 4.7300 on low turnover. For today, we expect it to hover around this level.

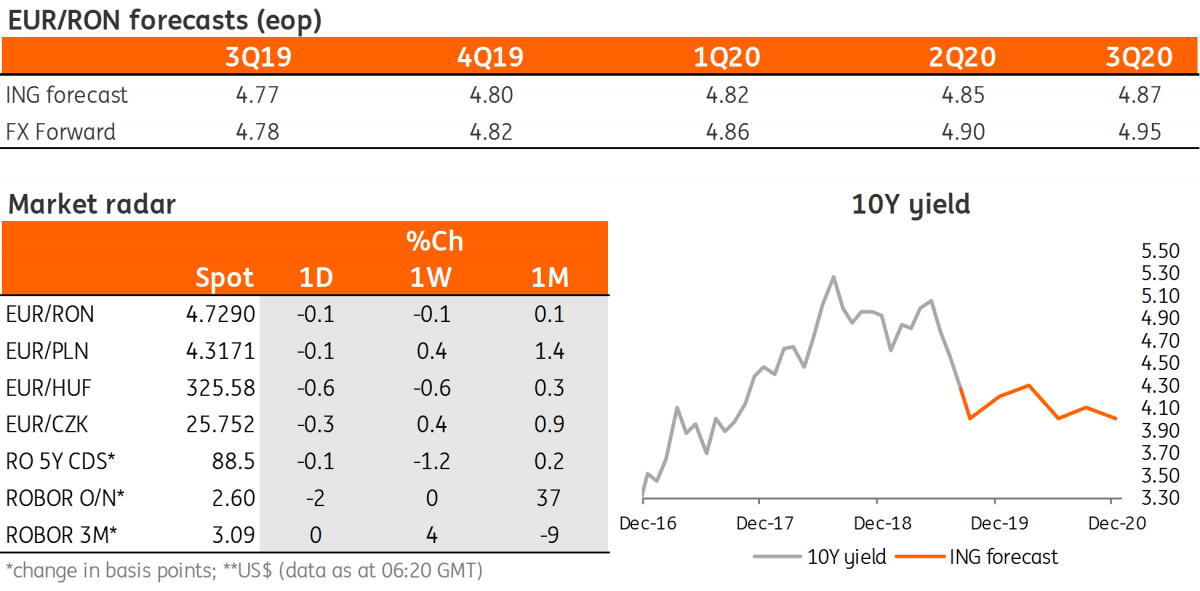

Government bonds

With the core markets apparently engaged in a race to the bottom, the spillover into emerging markets continues and Romanian government bonds are still benefiting from it. Longer end yields inched lower by some 10 basis points yesterday, more than reversing the little correction we saw in previous days. Today, the Ministry of Finance plans to sell RON400 million in Sep-2031 which still offers a nice yield pick-up in our view. To the extent the MinFin will not upsize the allocation, we could see the average yield inching below 4.30%.

We will also have a RON200million 1Y auction which generally doesn’t gather much demand but given the small target amount it should turn out positively. We look for an average yield just above 3.00% for this one.

Money market

Cash rates remain anchored just above the key rate as liquidity conditions remain broadly balanced.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap