Briefing Romania

“Strict” liquidity control?

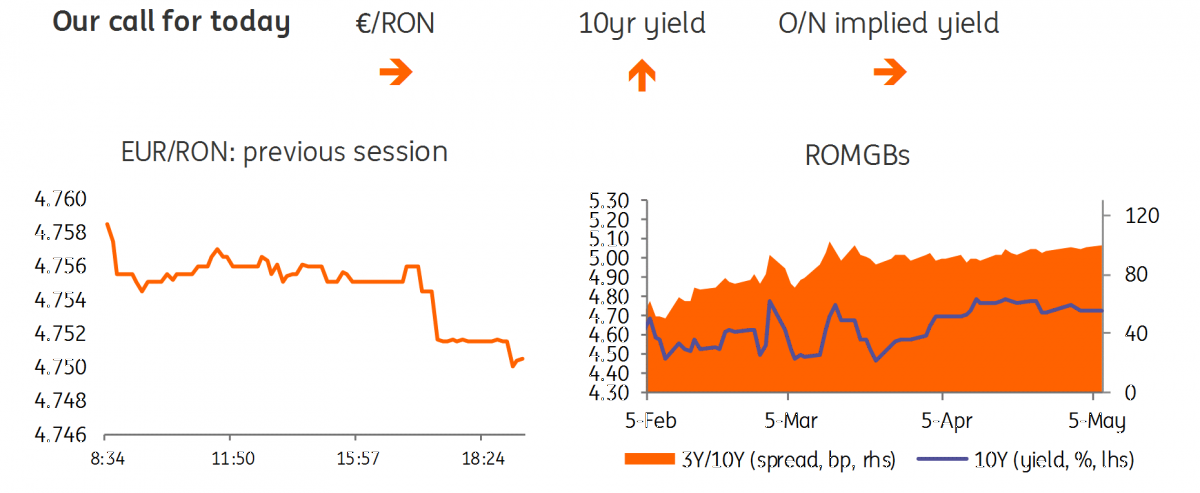

EUR/RON

The EUR/RON inched below 4.7550 on Friday in what was a slightly more animated trading session. As risk sentiment turned negative again over the weekend, we don’t see further downside potential for the pair.

Government bonds

Today the Ministry of Finance starts its monthly auction calendar and plans to sell RON500 million in Aug-2022. The risk-off in global markets should be less relevant for this particular auction given the relatively short maturity. We expect reasonable demand around secondary market mid-yields of 3.95%.

Money Market

Cash rates remained around the 2.50% key rate where the market expects the central bank to mop surplus liquidity. We believe that a deposit taking auction will be announced, even though yields haven’t actually traded below 2.50%.

The week ahead

In the US the March trade balance numbers are likely to deteriorate, but from good levels. The will he - won’t he uncertainty over another round of President Trump tariffs on Chinese imports has led to significant volatility in trade numbers over the past six months. We will also have consumer price inflation data; headline CPI will be boosted by the surge in gasoline prices, but look out for a rise in core inflation too, given rising transportation fares and stronger housing component readings. In the Eurozone retail sales for March will come out and may shed some light on how much of a role consumption has played in strong growth performance. The final PMIs for April will also be closely watched after a poor first estimate.

With no major data on the local front, we expect the EUR/RON to trade with 4.7500-4.7700 for this week.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap