Briefing Romania

Romanian leu in top shape

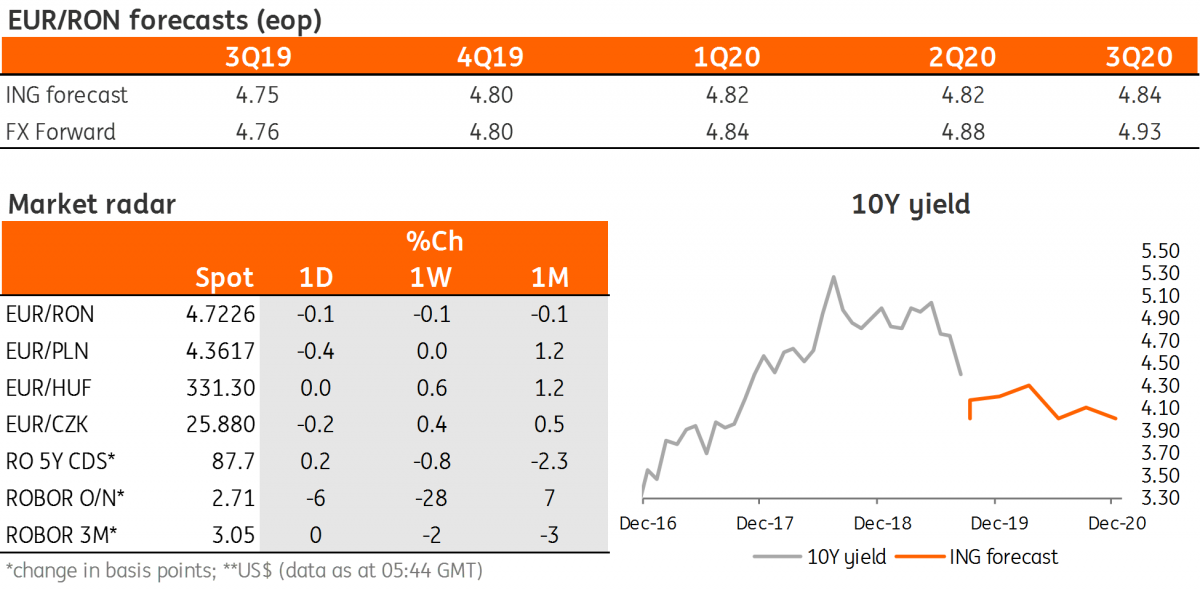

EUR/RON

Nothing seems able to destabilise the Romanian leu these days. The S&P rating assessment, IMF review or political turmoil (with the head of the upper Parliament chamber and president of the former junior government coalition party resigning yesterday) apparently had no impact on the EUR/RON which continues to trade between 4.7200 and 4.7300. S&P assumes “relatively firm” real exchange rates in its base-line scenario. The IMF stressed in its Article IV review “the need for a somewhat greater exchange rate flexibility” with its models suggesting an overvaluation of the real effective exchange rate of up to 10%. That’s quite a fine line for the NBR to walk.

Government bonds

Quiet fixed income market (due to the US holiday as well) with low liquidity facilitating some easy gains along the curve as yields shifted 2-3 basis points lower.

Money market

As expected, the NBR’s one week deposit auction attracted a higher interest from the local banks, with nine players leaving RON1.94 billion at the central bank. This is still at the lower end of our expectation though, hence we might see the front end inching slightly lower towards 2.00% before the NBR rolls over the deposit next week.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap