Briefing Romania

Last significant bond redemption of the year to keep carry stable

EUR/RON

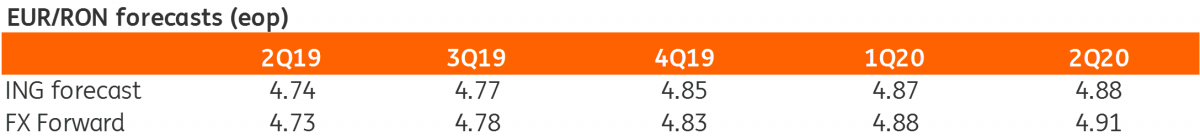

The downside pressure for EUR/RON seems to have been exhausted and the pair now looks more like a buy-on-the-dip story. On Friday, the cross closed just below 4.7300 which is around what we expect for today as well.

Government bonds

Romanian government bonds corrected a few basis points higher, likely on some profit taking. Today we have a RON500 million Sep-2023 auction which should see good demand though we feel that the recent optimism has faded a bit. Hence, an allocation in the 4.05% area looks reasonable.

Money market

An almost RON9 billion redemption coming back onto the market today should keep cash rates well anchored around the 2.50% key rate, particularly if the central bank rolls over its deposit taking auction.

Week ahead

Markets are anxiously waiting for the outcome of the Trump-Xi meeting at the G20 meeting on Friday and Saturday. A commitment to restarting the trade talks seems to be the best obtainable result. Both leaders want a deal but to avoid losing face they need to get concessions from the other side. Xi will have to assure Trump that China is willing to offer more than it did during the last round of talks. At the same time, Trump needs to assure Xi that he respects China by, for example, agreeing to reciprocity regarding penalties in case of non-compliance with the trade deal. Even if both leaders decide to resume the talks, there are too many bridges to be crossed to get a deal done quickly. We think this will lead to the US imposing another round of tariffs this quarter to ramp up the pressure. China will retaliate. Only after both sides experience the increasing negative effects of the trade war during the rest of this year will they be prepared to make concessions and finally strike a deal. Domestically, with the last bond auction for the month on Monday, we expect RON supportive inflows to fade and EUR/RON to trade within a 4.7200-4.7400 range.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap