Briefing Romania

10-year bonds below 4.0%?

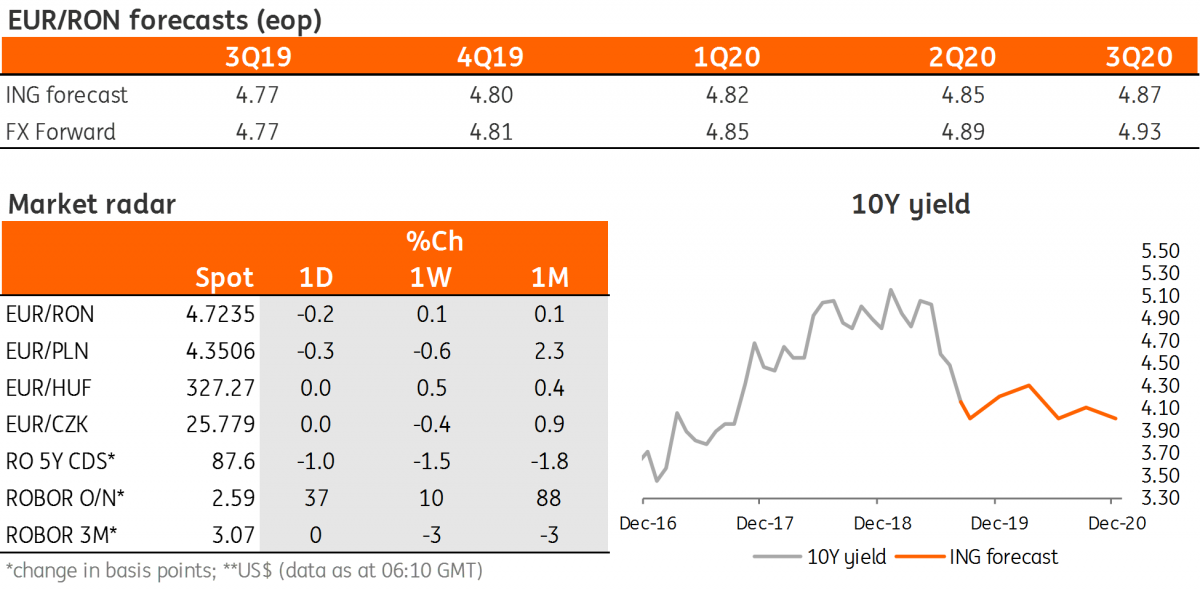

EUR/RON

The Romanian leu appreciated marginally yesterday, trading as low as 4.7220 against the euro on good turnover. Today’s 10Y bond auction could bring some additional inflows but we rather expect the pair to be stable as room for appreciation is likely limited to 4.7200.

Government bonds

In line with most of the moves seen in the central and eastern European space, Romanian government bonds traded defensively yesterday and yields inched higher by 5-6 basis points across the curve. Today’s RON500 million Feb-2029 auction should have been this month’s highlight but recent developments have softened expectations. Nevertheless, we expect good demand and the average yield to test the 4.00% level which would be a first in almost two years.

Money market

Although we didn’t attach a high probability to it, our call for a short-lived spike in cash rates seems to have materialised as implied yields reached and even crossed the 3.50% Lombard rate yesterday. The uncertainty around the timing of the monthly budget payments is likely the reason behind the spike. Things should get back to normal once the RON11 billion parked at the central bank returns to the market on Monday.

Download

Download snap